Cancellation of Held Warrants

If the paying agency determines a held warrant was issued in error, the agency may cancel the warrant. Gov. Code, Section 403.0552, subsections (d) and (e) govern the requirements for the cancellation of a held warrant. Subsection (e) prohibits the cancellation of a held warrant merely because it is on hold.

Subsection (d) requires the paying agency obtain consent to cancel a held warrant from each hold source agency before it is canceled. Access the Agency Hold Reason Inquiry (RSNINQ) screen to obtain contact information for each hold source agency. The hold source agencies’ consent must be:

- In writing.

- Obtained on a warrant-by-warrant basis.

- Retained for audit purposes.

Consent to cancel from the hold source agencies must be obtained as follows:

| If… | And… | Then… |

|---|---|---|

| The paying agency is also the hold source agency, | It is the only hold source agency, | The agency should seek consent from its own hold source agency contact. |

| The paying agency is also a hold source agency, | The warrant is on hold by other hold source agencies, | The paying agency must obtain consent from its own hold source agency contact and the other hold source agencies. |

| The paying agency is not a hold source agency, | The warrant is on hold by one or more hold source agencies, | The paying agency must obtain consent from each hold source agency. |

The warrant must be canceled within 30 days from the warrant issue date to prevent the warrant hold offset process. If the warrants are offset, the paying agency must recoup the funds from the hold source agency. Once consent to cancel is obtained from the hold source agencies and the:

| Payment type is: | Then… |

|---|---|

| Payroll, | Cancel the warrant via the statewide payroll system from which the warrant was issued. |

| Vendor, Travel or Payroll Deduction Warrant, | Use:

|

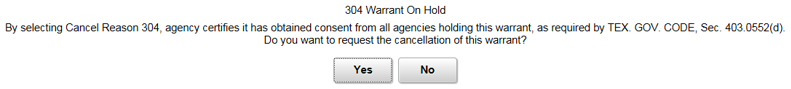

When cancelling a held warrant via WWIC, the following dialogue box is displayed:

WWIC requires the selection of Cancel Reason 304 Warrant on Hold, regardless of the reason for cancellation, and prompts for a Yes or No response.

- Click Yes to certify consent has been obtained to proceed with the cancellation.

- Click No if consent has not yet been obtained. Obtain consent from the hold source agencies before proceeding with the warrant cancellation.

The 304 Warrant on Hold status remains static in WWIC even after the warrant has been released from hold.

- Consent to cancel from the hold source agencies is no longer required if the cancellation is processed after the held warrant was released.

- Click Yes to proceed with the cancellation.

- For audit purposes, it is recommended the agency retain a screen shot of either or both of the following screens that show the warrant is not on hold and/or the date the warrant was released is prior to the date the warrant is canceled:

The cancellation of held warrants via WWIC or the payroll systems generates a Payment Services report, which is used to pull and destroy the canceled held warrants if the held warrants are still in the Comptroller’s possession.

Agencies can view the status of a payee’s held and released warrants on the following online screens, based on user security: