Payment Search

Search State Payments Issued (SSPI)

SSPI is a payment search tool that allows state vendors and payees to search payments issued through the Comptroller’s office. Users can access SSPI through the Comptroller’s eSystems Webfile application.

Before the state can issue payments, the paying agency must set up the payee in the Comptroller’s system that assigns each payee an 11-digit Texas identification number (TIN) based on the:

- Employer identification number (EIN)

- Social Security number (SSN)

– or – - Individual Taxpayer Identification Number (ITIN)

The step-by-step instructions and screen samples here help users navigate SSPI. However, the paying agency is the best source for answers to questions about state payments, remittance information and the status of outstanding payments. See Paying Agency Contact List for paying agency contact information.

To search warrants and direct deposit payments:

- State vendors/payees: Search state payments issued by any state agency or institution of higher education via the Comptroller’s office. Remittance information displayed on SSPI is based on the information the paying agency submits to the statewide accounting system. Contact the paying agency for any additional remittance information.

- State employees: Search travel reimbursement payments only. Contact your agency for the status of outstanding travel claims.

The following types of payments and payment information are not available on SSPI:

- Payments that have not been processed, are pending or have not been issued. Contact the paying agency for the status of outstanding payments.

- State retirement/pension payments. Contact the appropriate state retirement system with questions about these payments:

- Employees Retirement System (877) 275-4377

- Teacher Retirement System (800) 223-8778

- Texas Emergency Services Retirement System (512) 936-3422

- State employee payroll payments or earnings statements. State employees should contact their agencies’ payroll or human resource officers with questions about these payments.

- Payments issued from a state agency’s local funds.

- Confidential remittance information such as patient names or Social Security numbers are prohibited based on federal and/or state laws. Contact the paying agency for remittance information.

- IRS Form 1099. Contact the paying agency for assistance.

SSPI also provides an Advanced Payment Notification (APN) option to request an email alert the business day after a warrant or direct deposit payment is issued.

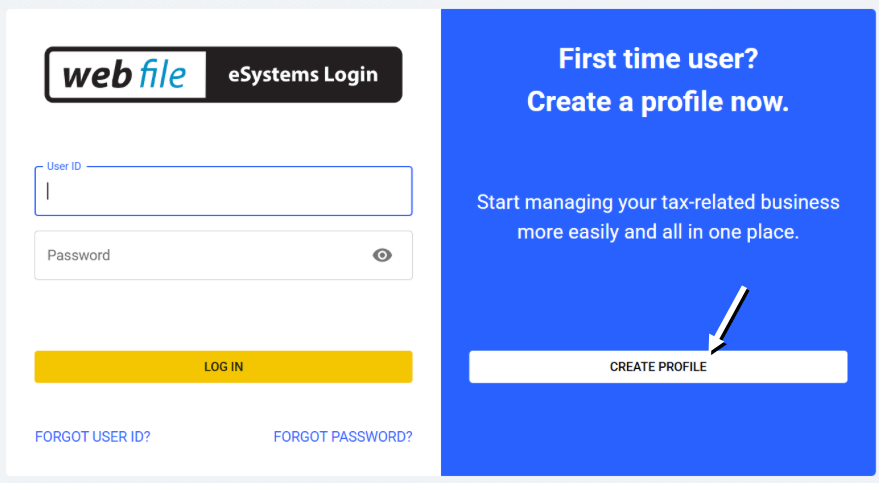

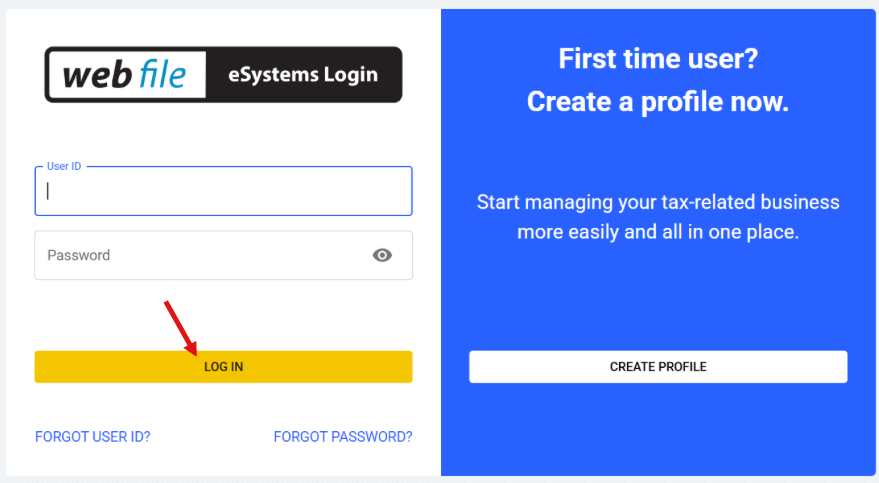

First-time SSPI users must first create a profile on the eSystems Webfile application:

- Select the CREATE PROFILE button on the login screen.

- Follow the instructions to create your profile.

- Then log back into eSystems by entering your user ID and password.

Do not share user IDs and passwords. Business entities may have multiple users who need to access payments. Each individual user must create a separate profile with a unique user ID and password that must not be shared.

SSPI Instructions

Follow these instructions to:

Set Up SSPI TINs

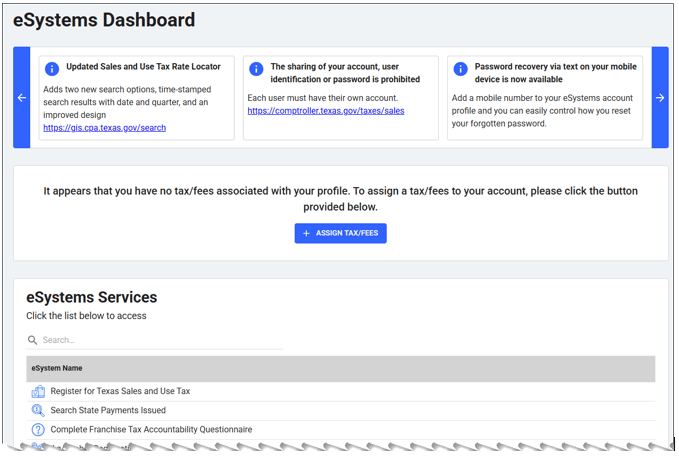

After creating an eSystems profile:

- Log into eSystems.

- Enter your user ID and password.

- The eSystems dashboard displays.

- From the eSystems dashboard, scroll down to eSystems Services and select Search State Payments Issued from the list.

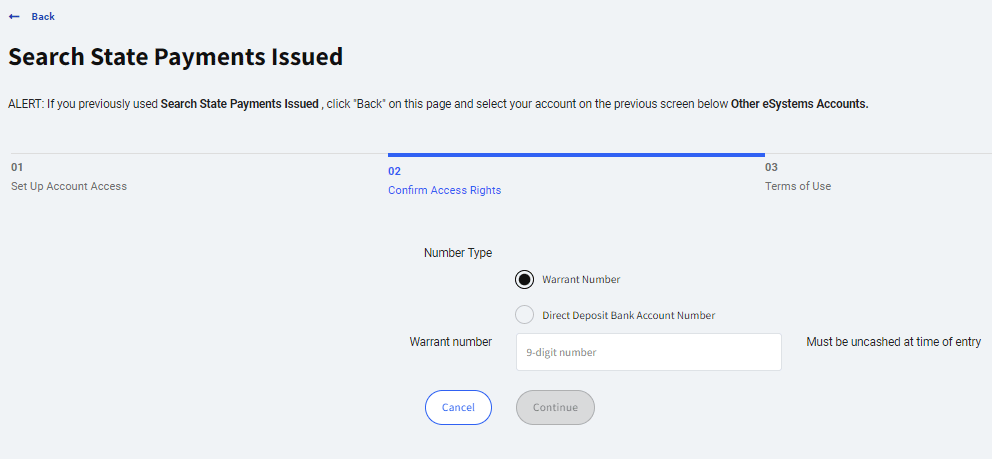

The Search State Payments Issued screen displays:

- 1 Set Up Account Access

- 2 Confirm Access Rights

- 3 Terms of Use

- From the 1 Set Up Account Access screen:

- Select the type of identifying number:

TEXAS IDENTIFICATION NUMBER (TIN): Must be 11 digits.EMPLOYER IDENTIFICATION NUMBER (EIN): Must be nine digits.SOCIAL SECURITY NUMBER (SSN): Must be nine digits.INDIVIDUAL TAXPAYER IDENTIFICATION NUMBER (ITIN): Must be nine digits.

- Enter the nine- or 11- digit number in the selected field. The number entered must be on record with the Comptroller’s office and must have received a state payment by warrant, direct deposit or both.

- Select Continue to navigate to the 2 Confirm Access Rights screen.

- Error messages display below the selected field and must be corrected before users can navigate to the next screen.

- Correct the errors and select Continue again.

- Select the type of identifying number:

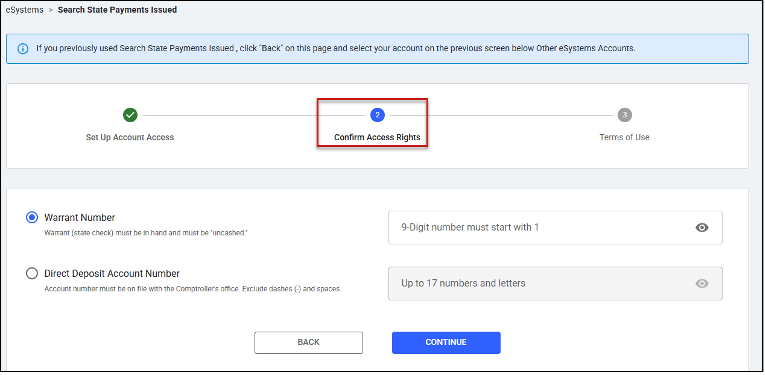

- From the 2 Confirm Access Rights screen:

- Select a radio button:

WARRANT NUMBER: Must be nine digits and the warrant must be uncashed at the time of entry.DIRECT DEPOSIT ACCOUNT NUMBER: Must be on record with the Comptroller’s office. Exclude hyphens (-) and/or spaces.

- Enter the nine-digit warrant number or direct deposit account number for the selected field.

- Select Continue to navigate to the 3 Terms of Use screen.

- Error messages display below the selected field and must be corrected before users can navigate to the next screen.

- Correct the errors and select Continue again.

- Select a radio button:

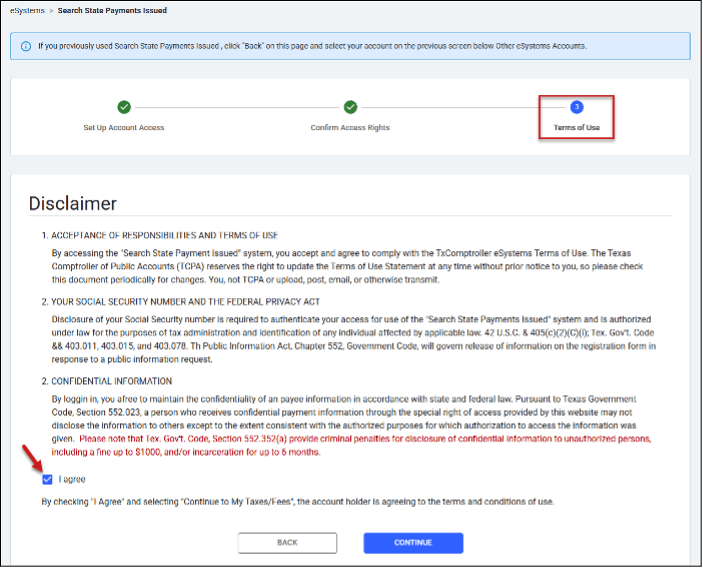

- From the 3 Terms of Use screen titled Disclaimer:

- Select the check box next to I Agree.

- Select Continue. The eSystems dashboard displays.

-

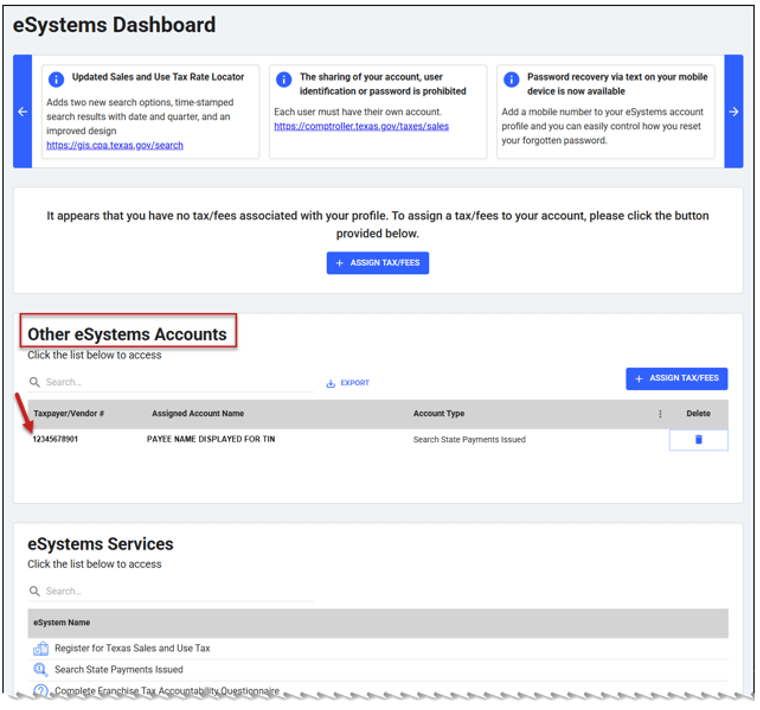

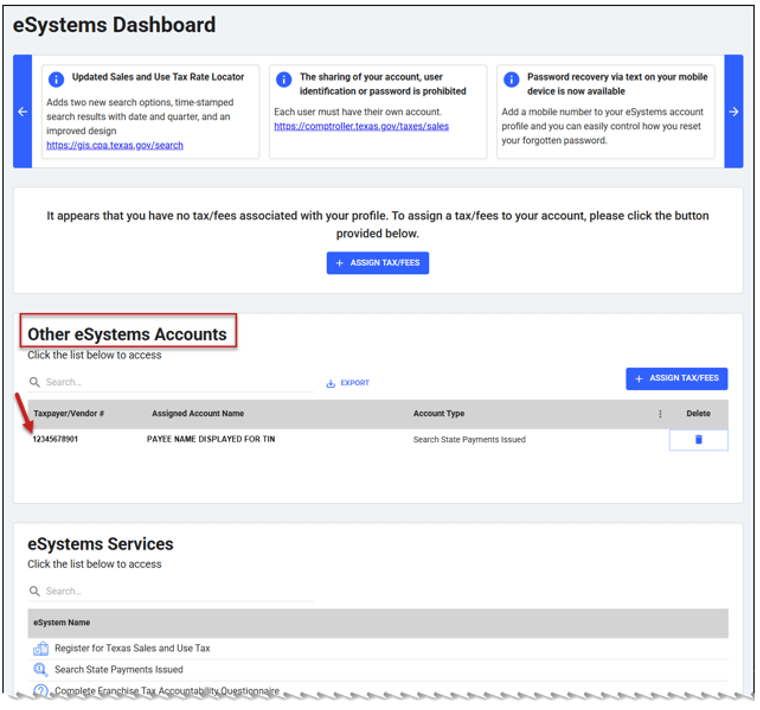

From the eSystems dashboard, scroll down to Other eSystems Accounts. The TIN you set up is displayed in the list, indicating the TIN setup process was successfully completed.

For instructions for searching payments on SSPI, see Perform an SSPI Payment Search.

Perform an SSPI Payment Search

Follow these steps:

- After creating an eSystems profile using the steps in Set Up SSPI TINs.

– or – - If you are a return user of SSPI with established TINs access.

- Log in to eSystems.

- Enter your user ID and password.

- Select LOG IN.

Once you log into eSystems, the eSystems dashboard displays.

- Scroll down to Other eSystems Accounts. From the list, select the 11-digit number below the Taxpayer/Vendor # column with "Search State Payments Issued" in the Account Type column to navigate to the SSPI payment search screen.

- If more than one number is listed, select a number that has been set up for SSPI access.

- If you need to set up additional TINs for SSPI access, repeat the steps in Set Up SSPI TINs for each unique TIN using a warrant number or direct deposit account number issued to that TIN.

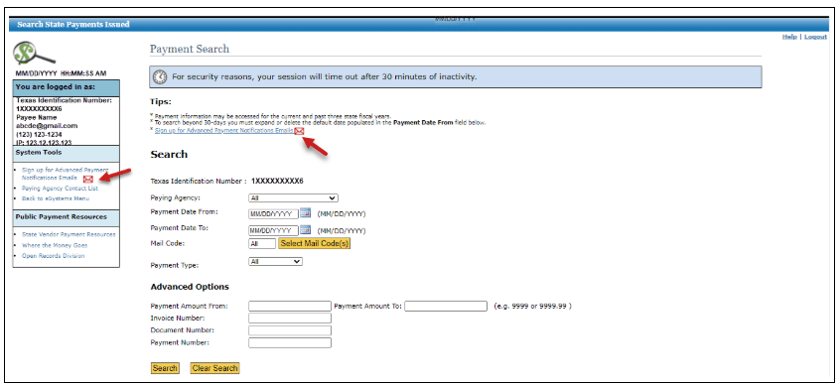

The SSPI Payment Search screen displays the Search menu.

The Advanced Payment Notification (APN) links and envelope icons display on this page in the System Tools box on the left and above the Search heading.

- Select the links or the envelope icons to set up APN. See Set up APN for instructions and screen samples.

- Select from the fields displayed on the Payment Search screen to perform a search.

PAYING AGENCY

If you receive payments from … Then … Only one agency The field defaults to that agency. Multiple agencies - The field defaults to the lowest agency number, followed by the agency name.

- Click the down arrow in this field to display the list of agencies.

- Select an agency from the list. Only one agency may be selected per search.

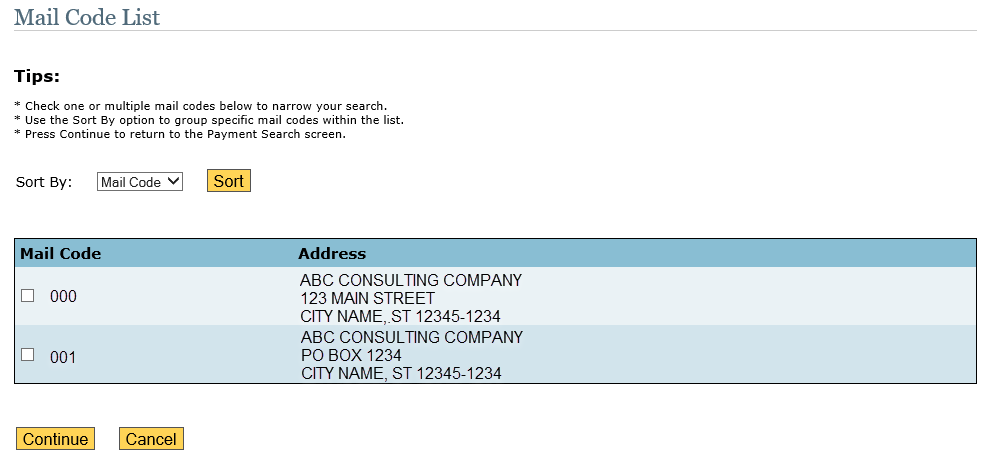

PAYMENT DATE FROM:Defaults to 30 days from current date. To change the default, enter a date in the MM/DD/YYYY format or select the calendar icon to choose a date.PAYMENT DATE TO:Defaults to current date. To change the default, enter a date in the MM/DD/YYYY format or select the calendar icon to choose a date.MAIL CODE:Defaults to All. If you receive payments on multiple mail codes, select Select Mail Code(s) to display the Mail Code List screen.

- The

SORT BYfield defaults to Mail Code and displays a dropdown menu with the following sort options. If you change the default, select Sort.- Name A-Z

- Name Z-A

- City A-Z

- City Z-A

- State A-Z

- State Z-A

- Zip 0-9

- Zip 9-0

- Select the check box(es) for one or multiple mail codes in the list, then select Continue to return to the Payment Search screen. The

MAIL CODEfield displays with:- The selected mail code if only one mail code is selected.

- The word Multi if multiple mail codes are selected.

- The

PAYMENT TYPE: Defaults to All. Select the down arrow in this field to change to:- Direct Deposit – Displays only direct deposit payments.

- Warrant – Displays only warrants, including held warrants.

- Held – Displays only held warrants.

If … Then … No payments are on file for the selected payment type - The application displays the message No records found. Please revise the search criteria.

- Select New Payment Search to return to the Payment Search screen.

The warrant was issued as a held warrant The status of Held due to a state debt remains static and does not change, whether the warrant is released to the payee or offset against the state debt.

Contact Payment Services with questions about a held warrant.

PAYMENT AMOUNT FROM:

PAYMENT AMOUNT TO:

Enter amounts in the 9999 or 9999.99 format (without commas). Examples:

- For $10,150.00, enter 10150 or 10150.00.

- For $123.29, enter 123.29

INVOICE NUMBER:The value entered must match an invoice number the paying agency submitted to the accounting system.DOCUMENT NUMBER:The value entered must match the value assigned by the paying agency; limited to eight characters.PAYMENT NUMBER:Enter a nine-digit warrant number or a seven-digit direct deposit payment number.

- Select Clear Search to clear all field entries and reenter new fields.

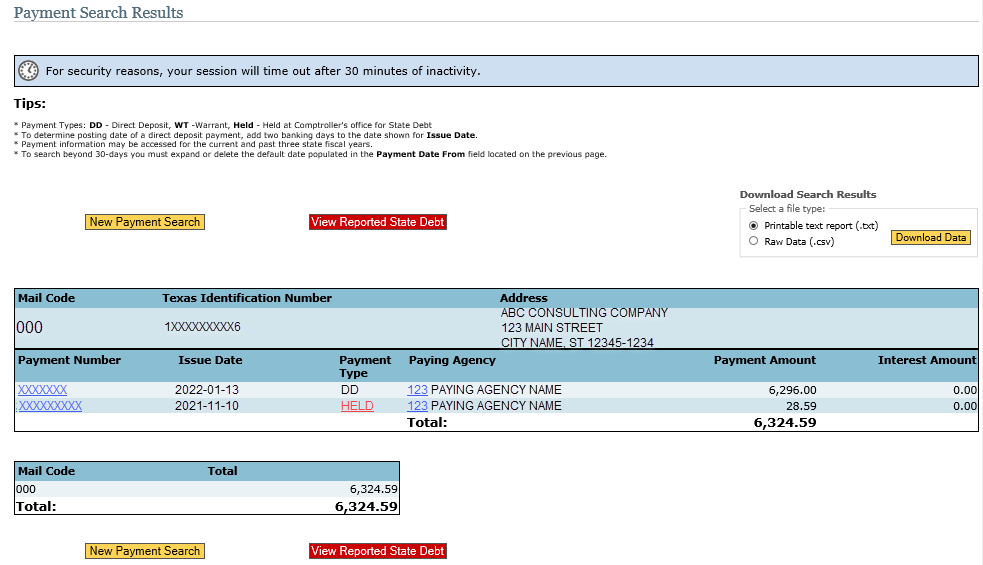

- Select Search to display the Payment Search Results screen.

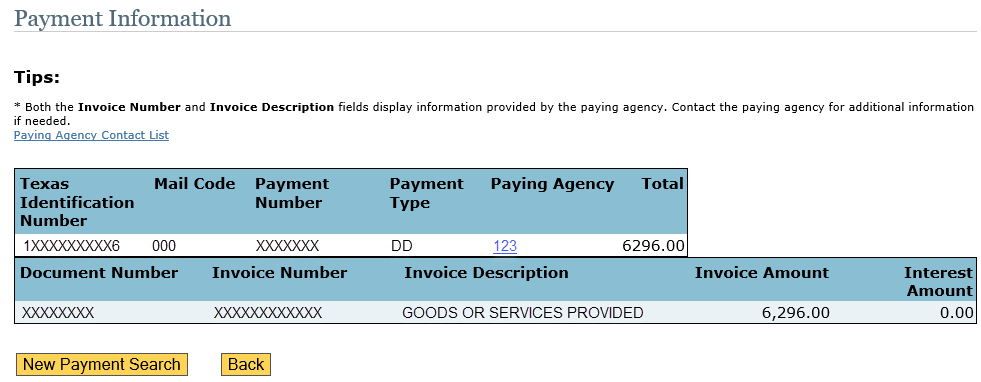

- Select a payment number to display the Payment Information screen. To return to the Payment Search Results screen, select Back.

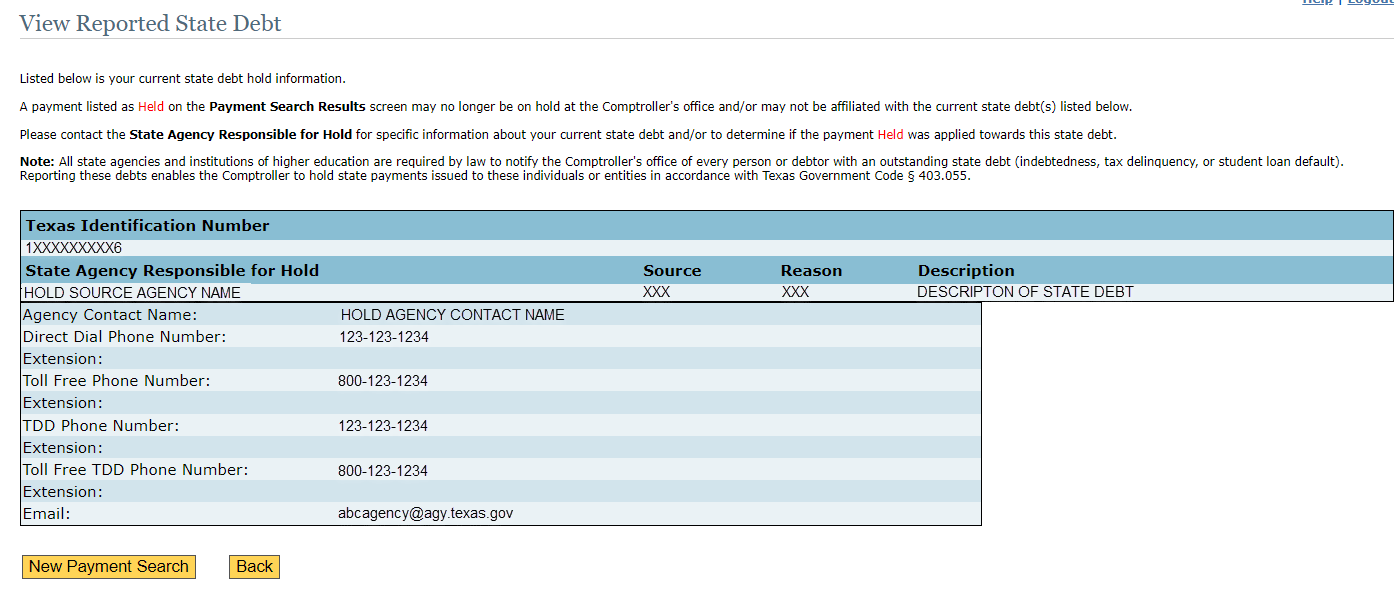

- Select Held under Payment Type or View Reported State Debt to display the View Reported State Debt screen with the hold reason description and hold source agency contact information. To return to the Payment Search Results screen, select Back.

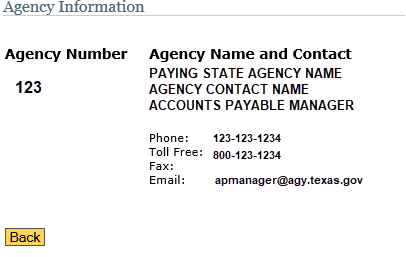

- Select the Paying Agency number to display the Agency Information screen. Contact that agency with any questions about the payment. To return to the Payment Search Results screen, select Back.

- Select a payment number to display the Payment Information screen. To return to the Payment Search Results screen, select Back.

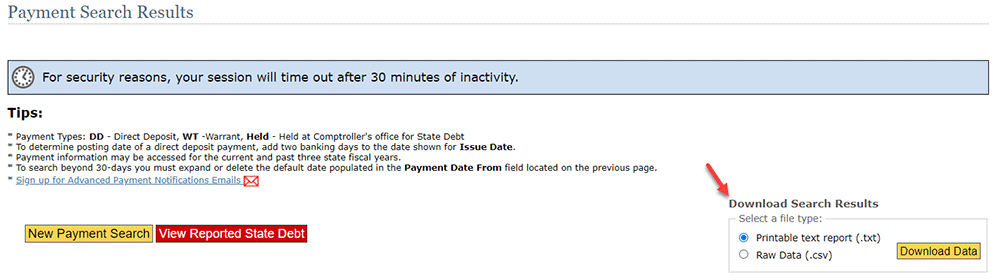

Download Search Results

Select a file type in the upper-right corner of the Payment Search Results screen for one of the following formats then select Download Data.

- Printable text report (.txt) – Default.

- Comma-separated values (CSV) or raw data file.

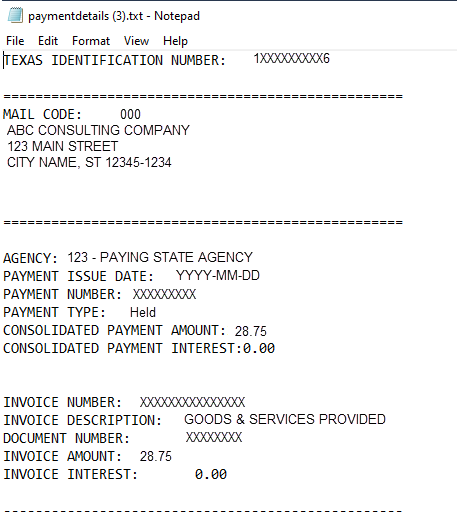

Printable Text Report (Sample)

CSV Report

The results are downloaded into an Excel spreadsheet with the following column headings (columns A–V, which can be adjusted as needed):

- Texas Identification Number

- Mail Code

- Payee Name

- Address Line 1

- Address Line 2

- Address Line 3

- Address Line 4

- City

- State

- Zip Code

- Payment Issue Date

- Payment Number

- Payment Type

- Consolidated Payment Amount

- Consolidated Interest Amount

- Invoice Amount

- Invoice Interest Amount

- Invoice Number

- Invoice Description

- Document Number

- Paying Agency ID Number

- Paying Agency Name

Log Out

Select Logout in the upper-right corner. The eSystems login page displays.