USAS and CAPPS Financials Confidentiality Indicator

Issued: July 28, 1999

Updated: April 4, 2025 – View Changes

Details

- Overview

- Determining Confidentiality

- Marking Transactions as Confidential

- Expenditure Transfer Vouchers

- How the Confidentiality Indicator is Used

- Reclassifying Transactions

Resources

- Transaction Entry in USAS Coding Instructions (FPP Q.010)

- Transparency Requirements: State Revenue and Spending Tools (FPP G.004)

- Confidential Employee Information for Open Records Requests (FPP L.004)

Contacts

USAS

CAPPS

Contact your agency’s CAPPS support staff with questions.

Authorized agency support staff may contact the CAPPS Service Desk at

(512) 463-2277 for additional assistance.

Overview

Applicable to

State agencies and institutions of higher education entering data in USAS and CAPPS Financials.

Policy

The ability of the Texas Comptroller of Public Accounts to accurately distinguish confidential and non-confidential payments is critical in making payment information promptly available to the public. State agencies and institutions of higher education (agencies) must ensure that the confidentiality indicator in the Uniform Statewide Accounting System (USAS) or the Financials application of the Centralized Accounting and Payroll/Personnel System (CAPPS Financials) is properly marked on confidential transactions to protect payee confidentiality.

Per Texas Government Code, Section 403.024d, the liability for the release of confidential information due to an incorrect confidentiality indicator lies with the agency submitting the confidential transaction.

The Comptroller’s office uses the value agencies enter in the confidentiality indicator field to shield confidential transactions from disclosure in requests under the Public Information Act (Texas Government Code, Chapter 552) and on the Texas Transparency website. The value is also used in the Texas Identification Number System (TINS) and Treasury Operations’ Web Warrant Inquiry and Cancellation System (WWIC).

Note: USAS is the accounting system of record for the state of Texas. Data entered in CAPPS Financials is loaded to USAS via batch interface.

Determining Confidentiality

Under state law, it is the responsibility of the agency submitting a transaction to determine the confidentiality of the transaction. Transactions are legally considered public unless specifically excluded by the Public Information Act (Texas Government Code, Chapter 552). When an agency marks a transaction confidential, the agency should be prepared to cite the law or attorney general opinion that excludes the payment from public disclosure.

Agencies also have a responsibility to keep confidential information private. In addition to properly marking the confidentiality indicator on confidential transactions, data items described in Business and Commerce Code, Section 521.002, must not be entered into a field not specifically created for that information unless explicitly allowed by Comptroller’s office policy.

Note: Information considered to be protected health information under the Health Insurance Portability and Accountability Act (HIPAA) privacy rule must not be submitted to the Comptroller’s office in USAS, CAPPS Financials or by any other method.

See USAS and CAPPS Financials Invoice Number Field Requirements (FPP E.023) for more information.

Marking Transactions as Confidential

In USAS

Confidentiality Fields

Agencies are required to appropriately mark transactions in USAS as confidential using any of the following fields:

- Confidentiality indicator (

CONF) field on the Pre-Enc/Enc/Expend Transaction Entry (505) screen. - Confidentiality indicator (

CONF) field on the Revenue/Receipts Transaction Entry (504) screen. CONF INDfield on the Detail Transaction (login required) input record via electronic batch input file.

Note: The Comptroller’s office considers vendor/payee numbers to be sensitive and does not include this element in reports accessible to the public. Do not mark a transaction with a Y or S based solely on this element.

Valid Field Values

| USAS Field Value | Description |

|---|---|

| Blank (Default) |

Transaction contains no confidential information. |

Y |

Yes – The transaction is confidential and exempted from disclosure under the Public Information Act (Texas Government Code, Chapter 552). |

S |

Some – The transaction is not exempted from disclosure under the Public Information Act, but it contains some confidential information. For example, a transaction would be marked S if the payee’s address and telephone number are confidential, but the name and transaction amount are not. |

N |

No – Transaction contains no confidential information. |

In CAPPS Financials

Confidentiality Fields on CAPPS Vouchers

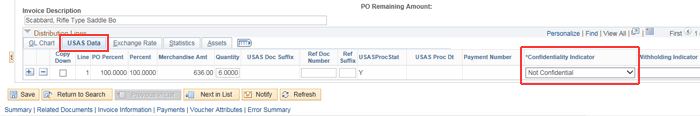

Agencies are required to use the Confidentiality Indicator* to mark appropriate transactions as confidential. It is located on the Accounts Payable/Regular Entry page under the Invoice Information tab, under the USAS Data sub-tab.

CAPPS Financials — Confidentiality Indicator Under the USAS Data Sub-tab

*Note: When data from CAPPS Financials is uploaded to USAS, the values entered in the Confidentiality Indicator field are converted to the valid values for USAS (Y, S or N).

Valid Field Values

| CAPPS Financials Field Value | Description |

|---|---|

| Not Confidential (Default) | Transaction contains no confidential information. Note: Field value converts to N when uploaded to USAS. |

| Confidential | The transaction is confidential and exempted from disclosure under the Public Information Act (Texas Government Code, Chapter 552). Note: Field value converts to Y when uploaded to USAS. |

| Some Confidential Info | The transaction is not exempted from disclosure under the Public Information Act, but it contains some confidential information. For example, a transaction would be marked Some Confidential Info if the payee’s address and telephone number are confidential, but the name and transaction amount are not. Note: Field value converts to S when uploaded to USAS. |

Confidentiality Fields on CAPPS Procurement Documents

Each procurement transaction in CAPPS includes the available fields CONF_ALL and CONF_SOME at the header level. If selected, the CONF_ALL or CONF_SOME value is carried to each successor document and affects transaction processing as described in the table below:

| If | Then |

|---|---|

| CONF_ALL is selected on a procurement contract | The LBB Contract Reporting field is set to NONE. |

| A contract ID is entered on a requisition line and the contract is set to CONF_ALL or CONF_SOME | The requisition is set to the same value automatically and the user cannot delete the setting as long as the contract is still marked CONF_ALL or CONF_SOME, even if other contracts associated with the requisition are not marked confidential. |

| A requisition marked CONF_ALL or CONF_SOME is sourced to a purchase order (PO) | The PO is set to the same value; the user cannot delete the setting as long as the requisition is marked CONF_ALL or CONF_SOME. |

| A requisition marked CONF_ALL or CONF_SOME is copied into a request for quote (RFQ) | The RFQ is set to the same value; the user cannot delete the setting as long as the requisition is marked CONF_ALL or CONF_SOME. |

| A PO marked CONF_ALL or CONF_SOME is pulled into a receipt | The receipt is set to the same value; the user cannot delete the setting as long as the PO is marked CONF_ALL or CONF_SOME. |

| A receipt or PO is copied into a voucher and receipt or PO is marked CONF_ALL or CONF_SOME | The voucher is also marked CONF_ALL or CONF_SOME; neither the user nor an accounting template can change the setting as long as the receipt or PO is marked CONF_ALL or CONF_SOME. |

| The voucher style is a multi-vendor voucher (MVV) | The confidentiality indicator is set to Y or S on voucher distribution lines associated with a PO marked as CONF_ALL or CONF_SOME. |

| A voucher is uploaded (EDI or Voucher Excel Spreadsheet Uploader file) with an associated receipt or PO that is marked CONF_ALL or CONF_SOME | The voucher is also marked CONF_ALL or CONF_SOME; neither the user nor an accounting template can change the setting as long as the receipt or PO is marked CONF_ALL or CONF_SOME. |

Important Note: The confidentiality value on a document can be increased (from NOT CONFIDENTIAL to CONF_SOME or CONF_ALL), but cannot be decreased below the confidentiality level of the predecessor document.

Expenditure Transfer Vouchers

If the original payment was marked as confidential or as containing some confidential information, any expenditure transfer voucher (ETV) transaction moving the expense must be marked the same to maintain the confidential designation.

In USAS

To process an ETV in USAS, use one of the following, making sure the confidentiality indicator contains the correct value (Y, S or N):

- The Pre-Enc/Enc/Expend Transaction Entry (505) screen

–OR–

- The Detail Transaction (login required) input record via electronic batch input file

Note: The Balanced JV Transaction Entry (509) screen is not available for this activity.

In CAPPS Financials

To process an ETV in CAPPS Financials, use the Invoice Information tab on the Accounts Payable / Regular Entry page, making sure the confidentiality indicator is appropriately marked (Not Confidential, Confidential or Some Confidential Info).

Find Out More

For more information, see Correcting Bookkeeping and Cost Allocation Entries (APS 021) (FPP A.013).

How the Confidentiality Indicator is Used

The confidentiality indicator values in USAS (Y, S or N) are permanently stored in the accounting transaction history record. This includes the CAPPS Financials indicators uploaded by batch to USAS that were converted to the USAS values Y, S or N. No USAS or CAPPS Financials security restrictions are placed on a transaction based on this value.

Although the confidentiality indicator fields in USAS and CAPPS Financials are for informational purposes only, several other applications use this indicator as stored in the USAS accounting transaction history record:

- Public Information Act requests – Transactions marked Y or S are individually considered and confidential information is not disclosed. Additionally, the Comptroller’s office considers vendor/payee numbers to be sensitive and does not include them in reports accessible to the general public.

- Transparency Requirements: State Revenue and Spending Tools (FPP G.004) – Transactions marked Y are available to the public on the Comptroller’s Texas Transparency website with the payee name displayed as CONFIDENTIAL. Transactions marked S are disclosed since there is no confidential information in the fields shown on the website.

- The State Revenue and Expenditure Dashboard (formerly known as the Where the Money Goes database) displays vendor/payee name, comptroller object, payment written date, transaction amount and agency.

- The Data Center provides access to machine-readable, platform-independent raw datasets, such as monthly expenditures by agency that include comptroller object, vendor/payee name, payment date, appropriation number, appropriation year and appropriated fund. If the transaction has been marked Y, the payee name displays as CONFIDENTIAL.

Note: Vendor/payee numbers are not included in the State Revenue and Expenditure Dashboard or the Data Center.

- Treasury Operations’ Web Warrant Inquiry and Cancellation System (WWIC) – If a payment contains a transaction marked Y or S, special security access to confidential payments is required for either viewing or canceling the payment using the WWIC system.

- Texas Identification Number System (TINS) – The value entered for the confidentiality indicator as it appears in USAS (Y, S or N) is stored in TINS and reflected in the

CIfield on the PAYVEN screen.

Reclassifying Transactions

If an agency fails to mark the confidentiality indicator appropriately on a transaction, the Comptroller’s office has a procedure for Reclassifying Transactions as Confidential. Note that this procedure applies to the State Revenue and Expenditure Dashboard and Data Center only and not USAS or CAPPS. There is no procedure to adjust USAS or CAPPS confidential indicator history.

| Date | Updates |

|---|---|

| 04/04/2025 | Updated contact information; reviewed for currency and agency style |

| 02/07/2020 | Minor revisions for clarity |

| 02/08/2019 | Minor revisions for clarity |

| 12/28/2018 | Added new “Confidentiality fields on CAPPS procurement documents” subsection to “Marking Transactions as Confidential” section. |

| 02/16/2018 | Minor revisions for clarity |