USAS and CAPPS Financials Invoice Number Field Requirements

Issued: Sept. 25, 1998

Updated: Oct. 31, 2025 – View Changes

Details

- Overview

- Confidential Information

- Protected Health Information Prohibition

- Payment and Travel Card Account Numbers

Contacts

For expenditure assistance, contact:

Your agency’s Purchase and Travel contact.

For questions on the protected health information prohibition, contact:

The Comptroller’s privacy officer at (512) 936-4365 or jeffrey.knoll@cpa.texas.gov.

For questions on procurement or travel cards, contact:

Statewide Procurement Division (SPD) contract support at

(512) 463-3435 or chargecardprogram@cpa.texas.gov.

Overview

Applicable to

State agencies and institutions of higher education entering data in USAS and CAPPS Financials.

Policy

Valid INVOICE NUMBER field entries are required for certain transactions in the Uniform Statewide Accounting System (USAS) and the Financials application of the Centralized Accounting and Payroll/Personnel System (CAPPS Financials).

Payees must be able to identify and reconcile payments they receive from state agencies and institutions of higher education (agencies). Use the INV NO field in USAS or the INVOICE NO field in CAPPS Financials to provide payees with the payment-related information they need to reconcile payments.

Note: As outlined in this fiscal policy and procedure (FPP), payment-related information must not include any confidential or protected health information.

The invoice number is mandatory for both online and batch processing of the following document types:

| Document Type |

Description |

|---|---|

| 1 | Travel voucher |

| 2 | Purchase voucher – subject to procurement rules |

| 6 | Reimbursement (non-payroll) |

| 9 | Purchase voucher – exempt from procurement rules |

Procedure

Payment-related information may include:

- Invoice number.

- Customer account number (other than complete payment and travel card numbers and bank account numbers).

- Contract number.

- Purchase order number.

- Other information the payee has requested for reconciliation purposes.

To provide payees with the payment-related information needed to reconcile payments:

In USAS

Use the INV NO field on the Preenc/Enc/Expend Transaction Entry (505) screen. The field accepts a maximum of 30 characters. If you need to provide additional payment-related information, use the 80-character-maximum DESC field.

In CAPPS Financials

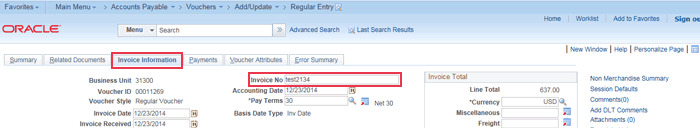

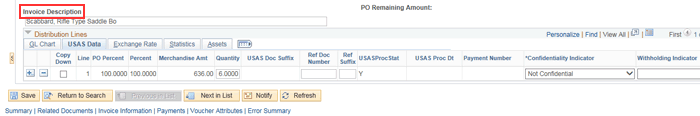

Single-Vendor Vouchers

For single-vendor vouchers (such as the regular voucher style), use the INVOICE NO field on the voucher header under the Invoice Information tab on the Accounts Payable/Regular Entry screen. The field accepts a maximum of 30 characters. If you need to provide additional payment-related information, use the 80-character-maximum INVOICE DESCRIPTION field.

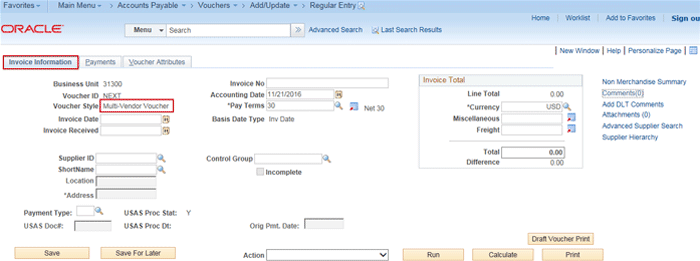

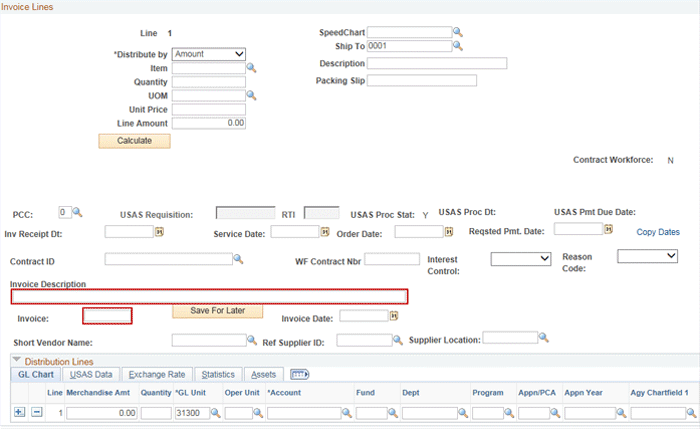

Multi-Vendor Vouchers

For multi-vendor vouchers (such as the Procard voucher style), use the INVOICE field on the voucher line under the Invoice Information tab on the Accounts Payable/Regular Entry screen. The field accepts a maximum of 30 characters. If you need to provide additional payment-related information, use the 80-character-maximum INVOICE DESCRIPTION field.

Confidential Information

Agencies have a responsibility to keep confidential information private. Data items described in Business and Commerce Code, Section 521.002 must not be entered into a field not specifically created for that information unless explicitly allowed by Comptroller’s office policy. Disallowed data includes:

- Name.

- Social Security number.

- Date of birth.

- Driver’s license number or government-issued identification number.

- Credit card number.

- Bank account or routing numbers.

- Medical information as covered by the protected health information (PHI) prohibition.*

- Any other sensitive information.

*The PHI prohibition includes medical payment-related information such as name, address, birth date, Social Security number or any part of that information that identifies or can be used to identify an individual.

Note: Under no circumstances should agencies enter into the USAS or CAPPS Financials INVOICE NUMBER or DESCRIPTION fields confidential or sensitive information such as complete or partial Social Security numbers or any other information covered by the PHI prohibition.

Protected Health Information Prohibition

Information considered to be protected health information (PHI) under the Privacy Rule in the Health Insurance Portability and Accountability Act (HIPAA) must not be submitted to the Comptroller’s office in USAS, CAPPS or by any other method.

PHI under HIPAA relates to:

- An individual’s past, present or future physical or mental health or condition.

- A provision of health care to the individual.

- A past, present or future payment for the provision of health care to the individual.

– or – - Any full or partial information such as name, address, birth date or Social Security number that identifies or can be used to identify an individual.

In addition to not submitting PHI in the USAS and CAPPS INVOICE NUMBER and DESCRIPTION fields, this prohibition includes PHI on any forms or other documentation submitted to the Comptroller’s office in support of a claim for payments for medical services or prescriptions.

The Comptroller’s office understands that agencies need to provide payees with information for payment reconciliation. Agencies should work with health care providers to identify alternative methods of providing PHI information. Contact the Comptroller’s privacy officer at (512) 936-4365 or jeffrey.knoll@cpa.texas.gov with questions.

Note: Agencies must also properly mark the confidentiality indicator (CONF field in USAS; CONFIDENTIAL INDICATOR field in CAPPS Financials) on confidential transactions to protect payee confidentiality. See USAS and CAPPS Financials Confidentiality Indicator (FPP E.045).

See the Texas Department of State Health Services Content Related to HIPAA for more information.

Payment and Travel Card Account Numbers

The payment and travel card corporate/managing account numbers described in this section are not required to be entered in the invoice number field by an agency or institution of higher education that is processing a reimbursement to the agency’s local account.

Entering procurement and travel card transactions in USAS or CAPPS Financials requires special considerations for the timely reconciliation of payments.

16-Digit Corporate/Managing Account Numbers

The corporate/managing account number on the billing statement for procurement and travel card transactions is a 16-digit number. This number is used for billing purposes only and is not an actual credit card number. These accounts include:

- Payment card (P-card)

- Central Billing Account (CBA) travel card

- Corporate Liability Individual Billed Account (CLIBA) travel card

- Virtual card accounts

Note: If a state employee obtains an individually billed (IBA) state travel or payment card, the account number on the billing statement is an actual credit card number. However, payments on IBA card statements are the sole responsibility of the cardholder and are not paid directly by the cardholder’s state agency.

Full 16 Digit Corporate/Managing Account Number Required in USAS and CAPPS

For payment and travel card payments, enter the full 16-digit corporate/managing account number (not an actual credit card number). For USAS, use the INV NO field. For CAPPS Financials, use the INVOICE NO field on the voucher header for single-vendor vouchers (such as the regular voucher style). For multi-vendor vouchers (such as the Procard voucher style), use the INVOICE field on the voucher line. As of Nov. 6, 2025, CAPPS Financials also requires 16 digits in the INV NO field of payment and travel card transaction entries. If you need to include additional information in these fields, you must use a dash after the 16-digit corporate/managing number. Do not enter spaces before or after the dash.

Payment/Travel Card Contract Update

Effective Sept. 1, 2025, the state of Texas began transitioning to a new charge card contract with U.S. Bank. The previous charge card contract with Citibank required a physical warrant for CLIBA payments. The current US Bank charge card contract requires all card types to be paid via direct deposit. If you have outstanding Citibank charge card statements requiring payment, instructions are available in the third-party transaction link at the end of this guide.

See Processing Third-Party Transactions in USAS for Payment/Travel Cards, Direct Bill Payments and Reimbursements (FPP A.043) (login required) for more information.

| Date | Updates |

|---|---|

| 10/31/2025 | Updated Overview and CBA and CLIBA Numbers sections to reflect new charge card payment requirements; updated single- and multi-vendor voucher screen shots |

| 11/15/2021 | Updated CBA and CLIBA Numbers section to clarify invoice requirements |