Reporting Requirements for Annual Financial Reports of State Agencies and Universities

Notes & Samples

NOTE 5 – Long-Term Liabilities

Instructions for the LTLN Web Application

The Long-Term Liability Note (LTLN) web application provides a user-friendly and intuitive method to electronically submit long-term liability note disclosures. LTLN ensures uniformity of these disclosures for ACFR Note 5 and automatically extracts USAS GL account balances for long-term liabilities.

Agencies can save work-in-progress in LTLN at any time and later recall a disclosure to edit or delete. Reports are available in HTML and PDF formats or as a download into an Excel file. LTLN produces a statewide database used for ACFR reports and disclosures. All agencies with long-term liability account balances are required to use LTLN to enter and certify disclosures.

In addition to submitting Note 5 from the agency’s AFR, the following agencies must submit disclosures in LTLN:

- State agencies

- Higher education systems

- Independent higher education agencies

Note: Components of university systems must not use LTLN.

Or click on the headings below to open a topic individually.

Deadlines for Entry [+]

The LTLN certification is due annually by:

- Oct. 1, 20CY — for GR consolidated agencies

- Nov. 1, 20CY — for unaudited agencies

- Nov. 20, 20CY — for unaudited institutions of higher education

- Dec. 1, 20CY — for audited full reporting agencies (including institutions of higher education)

To certify in LTLN, the agency must be completely reconciled to the active USAS beginning and ending total long-term liability GL amounts. USAS entries made to long-term liability GL accounts after the LTLN certification results in an LTLN to USAS out-of-balance status. If a USAS adjustment is necessary after certification, please contact your financial reporting analyst to uncertify the agency’s LTLN, confirm the USAS adjustments have posted and adjust LTLN to reflect the changes.

Submit a copy of the agency’s applicable note from its published AFR through the LTLN web application. The required format is a Microsoft Word document (latest version: docx) with header information that includes: agency name/number and note number/name. If any note contains a table, include the table in the Word document — rather than as a separate Excel document or other database application file. Do NOT submit a note to indicate “not applicable.”

Note: Screen prints from LTLN will not be accepted in lieu of the required copy of the agency’s Note 5 from its published AFR.

Disclosures Entered and Certified in LTLN [+]

After transaction activity and disclosure information is entered in LTLN, reports can be generated in the format of the:

- Summary of Changes Report

- Note Disclosures Report

- Debt Service Requirement Report – Notes and Loans (direct borrowing or placement)

- All Comments and File Attachments

Establish Security Access [+]

Ensure proper security access exists as early in the process as possible. Contact your agency’s security coordinator to request access to LTLN for each agency number you are reporting.

Note: When requesting access from your security coordinator, ensure that you communicate the four-character Security Coordinator’s USAS Reference Code specific to this web application.

General Information About LTLN [+]

System Records

Individual records are saved to the system based on the unique combination of agency, fund type and GAAP fund numbers.

Agency Number

You may access a different agency number if you have established security for that agency. Select the agency from the drop-down menu and click Go.

USAS GL Account Balances

USAS GL account balances are balances from the previous USAS cycle. To change a USAS GL account balance on a disclosure, exit LTLN and enter a USAS transaction. USAS must cycle in order for LTLN to update with the new USAS balance.

Screen Formats

Agency input boxes are the only fields available for entry. Other fields contain information calculated or pulled from USAS GL account balances and are display only.

Screen Navigation

Press Tab to move between input boxes and to calculate amounts without saving the disclosure. Click Save to save the disclosure with the data entered up to that point.

Save Feature

Click Save and the status box displays the message Saving data. Once a disclosure is saved, click Edit/Delete to make any changes to the existing disclosure.

Disclosure Screens

All disclosure screens require agency input in dollars and cents. Agency input amounts are reconciled to USAS GL account balances in dollars and cents. Differences between agency input amounts and USAS balances must equal zero before an agency can certify.

Amounts must be entered as either positive or negative to arrive at the correct ending balance.

The disclosure screens also include note disclosure sections for entry of descriptions of each type of obligation.

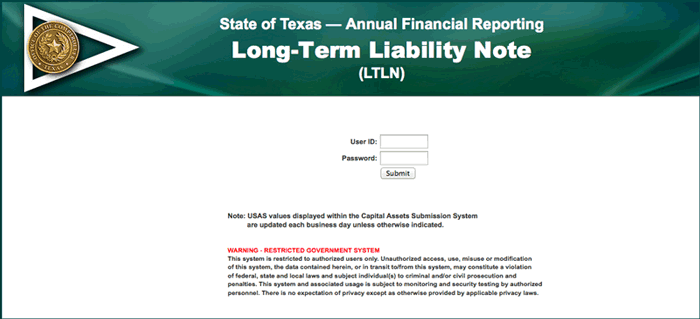

Log into LTLN [+]

Once proper security authorization is established, you can access LTLN.

- Enter your

USER ID.

Your User ID is the same as your ACID used to access the Comptroller’s mainframe and USAS. - Enter your

PASSWORD.

This is your USAS password. - Click Submit to enter LTLN.

If your LTLN security access is denied and an error message displays, contact your agency’s security coordinator.

LTLN loads long-term liability data and a status bar appears below the login information indicating that the system is processing. After processing is complete, LTLN returns to the Home screen.

Selecting an Agency and Choosing Note Disclosures [+]

The agency name(s) and number(s) are automatically retrieved from the security access permissible by your User ID. If you have access to multiple agencies, a drop-down menu displays a list of agencies for which you have access.

- Select an Agency from the drop-down menu.

- Click Go.

The screen automatically refreshes and displays the selected agency. The navigation bar at the left displays the various categories of long-term liability note disclosures to be submitted through LTLN.

- Click the applicable disclosure to begin entering disclosure information. Consider the following when choosing a disclosure category:

- What activities are long-term liabilities reported under at the agency:

- Governmental

- Business-type

- Discrete component units

- Some combination of the above

- What type of long-term liability disclosures are required for the agency:

- Claims and judgments

- Right to use lease obligations

- Right to use subscription obligations

- Employees compensable leave

- Notes and loans payable

- Notes and loans payable from direct borrowings

- Notes and loans payable from direct placements

- General obligation bonds payable

- General obligation bonds payable from direct borrowings

- General obligation bonds payable from direct placements

- Revenue bonds payable

- Revenue bonds payable from direct borrowings

- Revenue bonds payable from direct placements

- Pollution remediation obligations

- Asset retirement obligations

- Liabilities payable from restricted assets

- Availability payment arrangements

- Some combination of the above

- In what GAAP fund are these long-term liabilities reported?

Governmental will likely be in GAAP fund 9997, but business-type may be in a different GAAP fund. - Does the information contained in the Bond Reporting System (BRS) web application match the information entered in LTLN?

- Does the information contained in the Leases Note Submission System (LNSS) web application match the information entered in LTLN?

- What activities are long-term liabilities reported under at the agency:

Adding, Editing or Deleting Long-Term Liability Disclosures [+]

- Choose the relevant activity type in the left navigation menu:

- Governmental

- Business type

- Discrete component unit

- Click the disclosure (under your desired activity type) in the left navigation menu that you want to add, edit or delete.

- Claims and judgments

- Right to use lease obligations

- Right to use subscription obligations

- Employees’ compensable leave

- Notes and loans payable

- Notes and loans payable from direct borrowings

- Notes and loans payable from direct placements

- General obligation bonds payable

- General obligation bonds payable from direct borrowings

- General obligation bonds payable from direct placements

- Revenue bonds payable

- Revenue bonds payable from direct borrowings

- Revenue bonds payable from direct placements

- Pollution remediation obligations

- Asset retirement obligations

- Availability payment arrangements

- Liabilities payable from restricted assets

Note: Changes cannot be made in LTLN to disclosure amounts for General Obligation Bonds Payable and Revenue Bonds Payable — those amounts and information are pulled directly from the Bond Reporting System (BRS) web application and USAS. Changes to these disclosures must be done with the BRS web application and USAS.

Changes cannot be made in LTLN to disclosure amounts for Right to Use Lease Obligations or Right to Use Subscription Obligations (

DUE WITHIN ONE YEARfield;DUE THEREAFTERfield) — those amounts are pulled from LNSS.

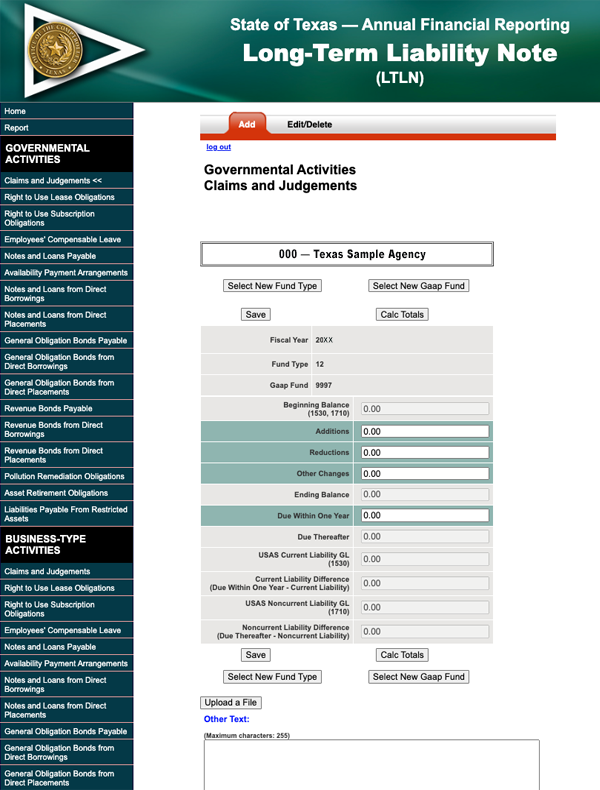

Each disclosure screen has two actions: Add and Edit/Delete (except the General Obligations Bonds Payable disclosure and Revenue Bonds Payable disclosure — they are display only). This screen automatically defaults to the Add action tab.

Adding a Disclosure

- Select the fund type where long-term liability balances are reported from the drop-down menu.

- Click Go.

- Select the GAAP fund where long-term liability balances are reported from the drop-down menu.

- Click Set GAAP Fund.

The system automatically refreshes and displays the data entry screen for the selected fund type/GAAP fund combination.

- Press Tab to navigate to the desired data entry field.

- Enter the applicable amounts and other information.

Available data entry fields include:

ADDITIONSREDUCTIONSOTHER CHANGESDUE WITHIN ONE YEAR

- Press Tab to move to the next data entry field.

Note: If you have JavaScript, LTLN automatically calculates totals and differences (where applicable). If you do not have JavaScript, click Calc Totals for recalculation. You may edit and recalculate as many times as necessary before proceeding to the next step.

- Confirm all long-term liability types are reconciled to the USAS ending GL account balance.

- Enter a brief description of the applicable long-term liability obligation in the Other Text data entry field.

–OR–

Click Upload a File to attach a file with this information.

The description is applicable to the liability in each activity and is only entered once. For example, the description entered for employees’ compensable leave in governmental funds automatically appears in the employees’ compensable leave disclosure screen for business-type activities.

Note: If entering a Notes and Loans Payable disclosure, you are also required to enter supplemental debt service information:- Click Debt Service at the bottom of the screen.

- Press Tab to navigate to the desired data entry field and enter the amounts (as applicable).

- Click Save at the bottom of the disclosure screen.

The screen automatically refreshes and moves the saved data to the Edit/Delete action tab.

Editing a Disclosure

If the agency/fund type combination displays, a disclosure was previously saved in LTLN — only an edit/delete to this disclosure is allowed:

- Select the disclosure (under your desired activity type) in the left navigation menu to edit.

- Claims and judgments

- Right to use lease obligations

- Right to use subscription obligations

- Employees compensable leave

- Notes and loans payable

- Notes and loans payable from direct borrowings

- Notes and loans payable from direct placements

- General obligation bonds payable

- General obligation bonds payable from direct borrowings

- General obligation bonds payable from direct placements

- Revenue bonds payable

- Revenue bonds payable from direct borrowings

- Revenue bonds payable from direct placements

- Pollution remediation obligations

- Asset retirement obligations

- Availability payment arrangements

- Liabilities payable from restricted assets

- Click Edit/Delete action tab.

LTLN displays the amounts as currently saved.

- Press Tab to navigate to the desired data entry field.

- Edit the amounts.

- Press Tab to move to the next data entry field.

Note: If you have JavaScript, LTLN automatically calculates totals and differences, where applicable. If you do not have JavaScript, click Calc Totals for recalculation. You may edit and recalculate as many times as necessary before proceeding to the next step.

- Click Save.

LTLN returns to the edit screen.

- Next, either:

- Choose another disclosure to edit

- Proceed to a different disclosure screen

- Click Log Out to exit LTLN

Deleting a Disclosure

- Select the disclosure (under your desired activity type) in the left navigation menu to delete.

- Claims and judgments

- Right to use lease obligations

- Right to use subscription obligations

- Employees compensable leave

- Notes and loans payable

- Notes and loans payable from direct borrowings

- Notes and loans payable from direct placements

- General obligation bonds payable

- General obligation bonds payable from direct borrowings

- General obligation bonds payable from direct placements

- Revenue bonds payable

- Revenue bonds payable from direct borrowings

- Revenue bonds payable from direct placements

- Pollution remediation obligations

- Asset retirement obligations

- Availability payment arrangements

- Liabilities payable from restricted assets

- Click Edit/Delete action tab to access the disclosure.

LTLN displays the amounts as currently saved.

- Click Delete.

LTLN returns to the edit/delete screen.

- Next, either:

- Choose another disclosure to edit

- Proceed to a different disclosure screen

- Click Log Out to exit LTLN

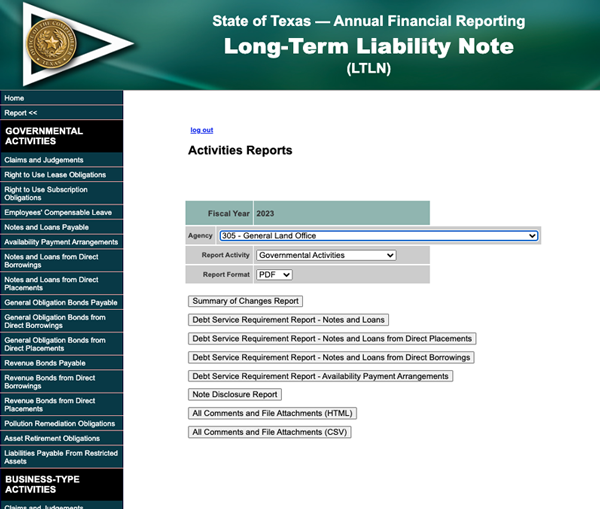

Reports [+]

Reports may be selected at any time. To run reports:

- Click Report in the left-hand navigational menu.

- Select the agency from the drop-down menu.

- Choose a relevant activity type from the report activity drop-down menu:

- Governmental activities

- Business type activities

- Discrete component unit activities

Run a separate report for each activity type if the agency disclosed long-term liabilities in multiple activity types.

- Choose a report format from the drop-down menu (PDF, Excel or HTML).

- Click the appropriate button to generate the following reports:

- Summary of Changes Report

- Debt Service Requirement Report – Notes and Loans (Direct Borrowing or Direct Placement)

- Note Disclosure Report

- All Comments and File Attachments

Certification [+]

From the Home screen:

- Select the Agency from the drop-down menu.

- Click Go.

- Click either:

- View Certification Status

Displays the agency’s certification status.

- Certify

Agencies must confirm all disclosures are complete by clicking Certify on the Home screen. Once certified, all disclosures are locked and only the ability to run reports is available.

Certification is not allowed until all disclosure screens are completely reconciled to USAS ending long-term liability GL account balances. If an adjustment is necessary after certification, please contact your financial reporting analyst.

- View Certification Status

LTLN for Consolidated University Systems [+]

Each consolidated university system (Agency numbers 792, 793, 794, 795, 797, 798 and 799) must enter the information for all of its component universities in total as described above. All entered amounts must reconcile to USAS amounts for the consolidated system and the consolidated university system AFR.

IMPORTANT: Components of university systems must not use LTLN.