General Revenue Reconciliation

Reporting Requirements for Annual Financial Reports of State Agencies and Universities

Note: To navigate this guide on a mobile device you must use the Table of Contents.

Reporting Requirements for Annual Financial Reports of State Agencies and Universities

General Revenue Reconciliation

References

Resources

- Agency Fiscal Year-End USAS Adjustments and AFR Checklist

- Step 1 – General Cleanup

- Step 2 – Review USAS Balances

- Step 3 – Investments

- Step 4 – Interagency Activity

- Step 5 – Binding Encumbrance and Payables

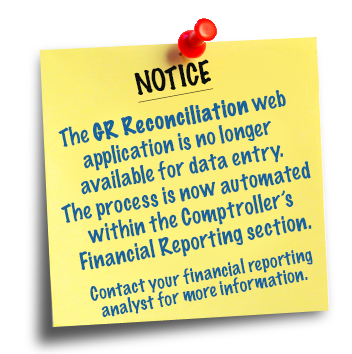

- Step 6 – General Revenue Reconciliation

- Step 7 – Statement of Cash Flows

- Step 8 – Notes to the Financial Statements

- Step 9 – Supplementary Schedules

- Step 10 – Analyze USAS Reports

- Step 11 – Review USAS Information

- Step 12 – Verify DAFRs and Complete AFR

- View Entire Checklist

- FAQs

- Definitions

- Appendices