Reporting Requirements for Annual Financial Reports of State Agencies and Universities

General Revenue Reconciliation

General Revenue Reconciliation

General Revenue Requirements for Annual Financial Reports

At the end of each fiscal year, a calculation is necessary to determine the amount of budget an agency was given by the General Appropriations Act (GAA), riders, some additional payroll expenditures and other special legislation — for example, benefit replacement pay (BRP) and old age survivors insurance (OASI) match. This calculation also determines the amounts used for the operating statement impact and the balance sheet asset amount for the remaining appropriation authority available to be spent in future years.

This calculation is determined by extracting balances for various entries made in USAS throughout the year. Due to the nature of the calculation, reports are available to assist agencies in determining accurate amounts to be used on the agency’s AFR. On a statewide basis, the accuracy of this number is critical in order to reconcile appropriated fund 0001 for the ACFR.

Instructions

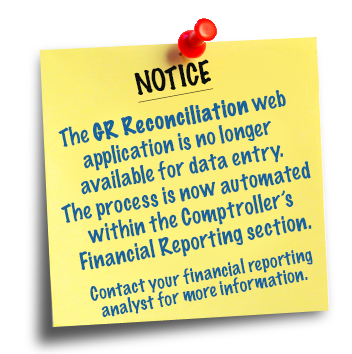

Each full reporting agency must submit a General Revenue (GR) Certification for the current fiscal year through the GR Reconciliation web application on or before Nov. 1, 20CY. The Comptroller’s Financial Reporting section completes the necessary USAS entries for all GR Consolidated Agencies (GCAs) and certifies the GR Certification for these agencies on or before Nov. 1, 20CY.

If the agency completes the AFR before the deadline, incorporate GR reconciliation amounts into the agency’s AFR.

Most fields in the GR Reconciliation web application are automatically populated from USAS. The web application provides a standardized reporting format for use by all agencies and collects the information in a central database used for ACFR analysis.