Reporting Requirements for Annual Financial Reports of State Agencies and Universities

Capital Assets

Impairment of Capital Assets and Insurance Recoveries

Identifying Potential Impairments

When the events or changes in circumstances leading to an impairment are prominent, consider the impairment for reporting under GASB 42. Generally, events or changes in circumstances are prominent when they prompt discussion by the governing board, management or the media.

No additional procedures beyond normal operations are needed to identify potential impairments.

Examples of events and circumstances to be considered are:

- Physical damage (for example, fire or flood)

- Obsolescence due to new technological development

- New laws or regulations (such as water quality standards that a water treatment plant does not meet and cannot meet)

- Changes in external factors or in the manner or duration of use such as:

- A school closes prior to the end of the building’s useful life

- A construction project stops due to lack of funding

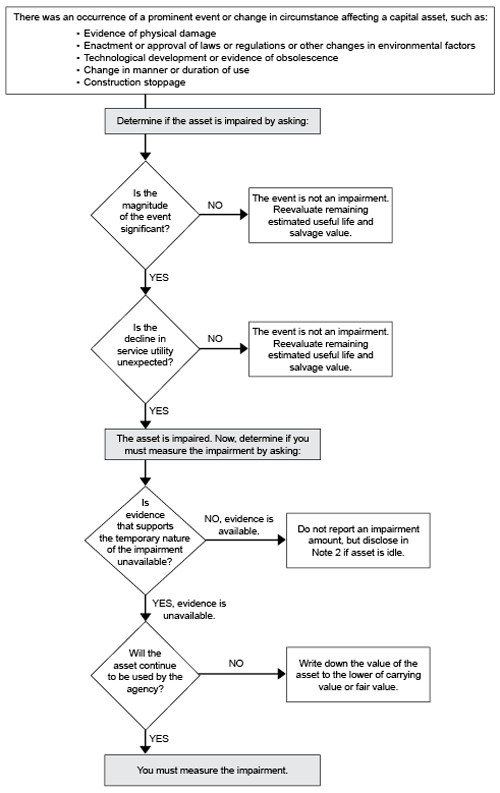

Asset Impairment Decision Process

Upon determination that a prominent event or change in circumstance affecting a capital asset occurred, evaluate if the asset is impaired by asking:

- Is the magnitude of the event significant?

- If No, the event is not an impairment. Reevaluate the remaining estimated useful life and salvage value of the asset.

- If Yes, proceed to question 2.

- Is the decline in service utility unexpected?

- If No, the event is not an impairment. Reevaluate the remaining estimated useful life and salvage value of the asset.

- If Yes, the asset is impaired.

Once it is determined an asset is impaired, next determine if you must measure the impairment by asking:

- Is evidence that supports the temporary nature of the impairment unavailable?

- If No (evidence is available), do not report an impairment amount, but do disclose in Note 2 if the asset is idle.

- If Yes (evidence is unavailable), proceed to question 2.

- Will the asset continue to be used by the agency?

- If No, write down the value of the asset to the lower of carrying value or fair value.

- If Yes, measure the impairment.

The asset impairment decision process as explained above is depicted in the graphic below: