Settlement and Judgment Processing Guidelines

Issued: June 3, 2004

Updated: January 13, 2023 – View Changes

Details

- Overview

- Settlement and Judgment Payment Guidelines

- Processing Instructions for the Payment of Settlements and Judgments

- Processing Instructions for the Payment of Settlements and Judgments – Pre-Litigation Settlements

- Sample Settlement Letter

- Sample Transmittal Memo for

Pre-Litigation Claims - Sample Purchase Voucher

- Sample Warrant Distribution Instruction Memo

- Settlement and Judgment Comptroller Objects

- Settlements and Judgments Quick Reference

Resources

Settlement and Judgment Payroll Processing form (74-232)

Contacts

For questions on the payment of settlements and judgments:

Fiscal Management Division

Expenditure Assistance section

(512) 475-0966

Fax: (512) 475-0588

Email: settlements.judgments@cpa.texas.gov

Overview

The guidelines and processing instructions for the payment of a settlement or judgment described in this Fiscal Policy and Procedure (FPP) comply with:

- General Appropriations Act (GAA), Article IX, Section 16.04, Judgments and Settlements.

- Applicable settlement and judgment riders in GAA, Article I, Fiscal Programs – Comptroller of Public Accounts, Strategy A.1.3.

Settlement and Judgment Payment Guidelines

Settlements and judgments must first be paid from the agency’s budget, under GAA, Article IX. In certain instances, the balance of any unpaid portion of the settlement or judgment may be paid from the Comptroller’s Fiscal Programs appropriation.

Payment of Settlements and Judgments by Agencies

Agencies must pay settlements and judgments in compliance with GAA Article IX, Section 16.04. The payment of a settlement or judgment from an agency’s appropriation:

- May not exceed $250,000.

– and – - The payment of a settlement or judgment may not exceed one percent of the total amount of funds appropriated by this Act for expenditure by that agency for that fiscal year (not including federal funds).

– and – - The payment of the settlement or judgment would not cause the total amount of settlement and judgment payments made by the payer agency for that fiscal year to exceed 10 percent of the total amount of funds available for expenditure by that agency for the fiscal year.

– and – - The payment of a settlement or judgment may be made only with a complete release from all related claims and causes against the state. In the case of a judgment, the payment may be made only in full satisfaction of that judgment.

- Any remaining unpaid balance may be eligible to be paid from the Comptroller’s Fiscal Programs appropriation for settlements and judgments, depending on the cause of action involved in the litigation and whether there are any remaining available funds for payment.

Appropriation Year Determination for Settlements and Judgments

GAA, Article IX, Section 16.04 sets the requirements for settlements and judgments. GAA, Article IX, Section 16.04 requires approval by the governor and the attorney general for payments of all judgments and settlements prosecuted by or defended by the attorney general.

An agency must charge a settlement or judgment to the current appropriation year unless the claim was finalized and approved by both the governor and the attorney general in the immediately preceding appropriation year. In this case, an agency may charge the settlement or judgment to the current appropriation year or the immediately preceding appropriation year. The Comptroller’s office uses the date of the transmittal letter received from the attorney general (or from the agency’s legal counsel if handled in-house as a pre-litigation settlement) as the final approval date.

Note: Pre-litigation settlements do not require approval by the governor or the attorney general.

In the event the settlement or judgment requires legislative approval, the Legislature will decide the appropriation year.

Payment of Settlements and Judgments by the Comptroller’s Fiscal Programs Appropriation

If the settlement or judgment exceeds the $250,000 and 10 percent limitations discussed above, the balance of any unpaid portion of the settlement or judgment may be paid from the Comptroller’s Fiscal Programs Article I, Strategy A.1.3, and riders 4-5 appropriation in the current GAA, provided there are sufficient funds in the agency 902 appropriation to make payment.

If all funds are lapsed or the claim does not qualify for payment by the Comptroller’s Fiscal Programs Article I appropriation, the Comptroller’s office will work with the attorney general to have the claim reviewed by the Legislature for possible funding. Submission of the claim to the Legislature does not guarantee approval and payment of the claim.

The types of litigation claims to be paid from the Comptroller’s Fiscal Programs Article I appropriation are limited to:

- Settlements and judgments related to state liability for the conduct of public servants under Chapter 101 and Chapter 104, Civil Practice and Remedies Code, including indemnification for criminal prosecution under Section 104.0035, Civil Practice and Remedies Code.

– or – - Federal court settlements and judgments.

– or – - Eligible medical malpractice claims that conform with Chapter 59, Texas Education Code.

Note: Litigation claims paid from an agency’s budget under Article IX are not limited to the types of litigation claims listed in the Comptroller’s Fiscal Programs appropriation in Article I.

If the settlement or judgment exceeds the $250,000 and 10 percent limitations and is not the type of settlement or judgment that may be paid from the Comptroller’s Fiscal Programs appropriation, neither the Comptroller’s office nor the agency has the authority to make a payment (full or partial) and the claim will require legislative approval before payment can be made.

Note: “Judgment” means a judgment order rendered in a federal court or a court in this state for which an appeal, rehearing or application therefore is not pending and for which the time limitations for appeal or rehearing have expired.

Processing Instructions for the Payment of Settlements and Judgments

| Step | Action |

|---|---|

| 1 |

The attorney general’s office (OAG) sends a letter to the paying agency requesting:

For specific examples, see Sample Purchase Voucher and Sample Warrant Distribution Instruction Memo and the Settlements or Judgments Coding Block Form (74-218). |

| 2 |

The purchase voucher is signed by an authorized employee of the paying agency verifying:

|

| 3 |

The paying agency enters the payment in the Uniform Statewide Accounting System (USAS) using Document Type 9 (or Document Type 5 for payroll):

Note: Agencies are responsible for determining how the payment will be reported to the Internal Revenue Service (IRS). Specific USAS comptroller objects are used to record settlement and judgment payments. See Settlement and Judgment Comptroller Objects for the objects and their descriptions. When a settlement or judgement includes compensation that is wage-related (i.e. back wages, etc.), the agency must process a payroll document and complete the Settlement and Judgment Payroll Processing form (74-232). The deductions should also be entered in the |

| 4 |

The paying agency forwards the following to the OAG once an agreement to settle the claim has been reached:

|

| 5 |

The OAG submits the documents and settlement agreement/judgment to the governor for approval:

The paying agency can review the USAS Document Tracking (S037) screen to verify when the document was approved. |

| 6 | In compliance with the warrant distribution memo, the warrants are delivered by courier to the OAG the next business day after the Comptroller’s office approves the document. |

| 7 | The purchase voucher and settlement/judgment documents are filed with the Comptroller’s office until the required retention period expires. |

Processing Instructions for the Payment of Settlements and Judgments – Pre-Litigation Settlements

A paying agency’s legal counsel may settle a dispute before a lawsuit is filed; this is known as pre-litigation. All statutory or GAA references apply to these claims with the exception that they do not require attorney general review or the governor’s signature. The following steps are required for pre-litigation claims:

| Step | Action |

|---|---|

| 1 | Pre-litigation claims can be paid with comptroller object 7221 and do not require settlement by the OAG or the governor’s signature. Pre-litigation claims are settlements for which a lawsuit has not been filed in any court. |

| 2 |

The paying agency enters the payment in USAS using Document Type 9 (or Document Type 5 for payroll):

Note: Agencies are responsible for determining how the payment will be reported to the IRS. |

| 3 | The paying agency submits the following to the Comptroller’s office after an agreement has been reached:

When a pre-litigation settlement includes compensation that is wage-related (i.e. back wages, etc.), the agency must process a payroll document and complete the Settlement and Judgment Payroll Processing form (74-232). The deductions should also be entered in the |

| 4 |

The Comptroller’s office reviews submitted documentation. If approved, the Comptroller’s office enters action code 550 (Approved by Audit) in USAS for payment. The paying agency can review the USAS Document Tracking (S037) screen to verify when the document was approved. |

| 5 |

Warrants are available for pickup by the paying agency at the Comptroller’s office the next business day following the day of the Comptroller’s office approval. |

| 6 |

The purchase voucher and settlement documents are filed with the Comptroller’s office until the required retention period expires. |

Sample Settlement Letter

Below is a sample settlement letter from the paying agency to the OAG authorizing the settlement or judgment and amount of the claim.

Note: The bolded paragraph in the sample letter below must be included in the settlement letter paying agencies submit to the attorney general’s office.

Note: The paying agency’s name/address/phone/website (if applicable) appears on the letterhead.

DATE: Month xx, xxxx (Ex: March 22, 2012)

TO: <Name of Assistant Attorney General assigned to case>

Assistant Attorney General

<Name of Assistant Attorney General Division assigned to case>

Office of the Attorney General

300 West 15th Street, 6th Floor

Austin, Texas 78701

RE: Payment of Settlement in Case No. ________; John Doe Industries

v.<Paying Agency>; Defendants, in the State of Texas; in the <###>

Judicial District of _____ County, Texas AG No. 99999999.

BODY TEXT:

Dear <Name of Assistant Attorney General assigned to case>,

The <Paying Agency Name> authorizes settlement of the above-referenced

claim in the amount of <$xx,xxx> payable to <Payee Name> in exchange

for the claimants’ full release of all claims arising out of this lawsuit.

This shall also serve to inform you that the <Paying Agency Name> <does>

OR <does not> consider this information to be confidential.

Payment of this claim does not exceed 1 percent of the total amount of

funds appropriated by the General Appropriations Act (GAA) for this agency

(not including federal funds) and would not cause the total amount of

settlement and judgment payments during the Fiscal Year(FY) to exceed

10 percent of the total amount of funds available for expenditure by

this agency.

Thank you for your prompt handling of this matter.

Sincerely,

<Name>, <Title of Authorized Agency Representative>

<Authorized Representative Division>

<Paying Agency>

Sample Transmittal Memo for Pre-Litigation Claims

Below is a sample transmittal memo from the paying agency to the Comptroller’s office for pre-litigation claims. This memo provides the information required by the Comptroller’s office to process the approval.

Note: The bolded paragraph in the sample memo below must be included in the transmittal letter paying agencies submit to the Comptroller’s office.

Note: The paying agency’s name/address/phone/website (if applicable) appears on the letterhead.

Expenditure Assistance Section Fiscal Management Division Texas Comptroller of Public Accounts LBJ Building Austin, TX 78711 RE: Claimant v. Agency <Agency> legal staff has settled the following pre-litigation claim and verifies that this claim is final. Please have the Comptroller issue a warrant for payment of the claim outlined in this letter. Payment of this claim does not exceed 1 percent of the total amount of funds appropriated by the General Appropriations Act (GAA) for this agency (not including federal funds) and would not cause the total amount of settlement and judgment payments during the Fiscal Year(FY) to exceed 10 percent of the total amount of funds available for expenditure by this agency. PRINCIPAL AMOUNT: AGENCY NAME: INCIDENT DATE: DESCRIPTION: TYPE: CONFIDENTIAL: FEES AND COSTS: Signature Block

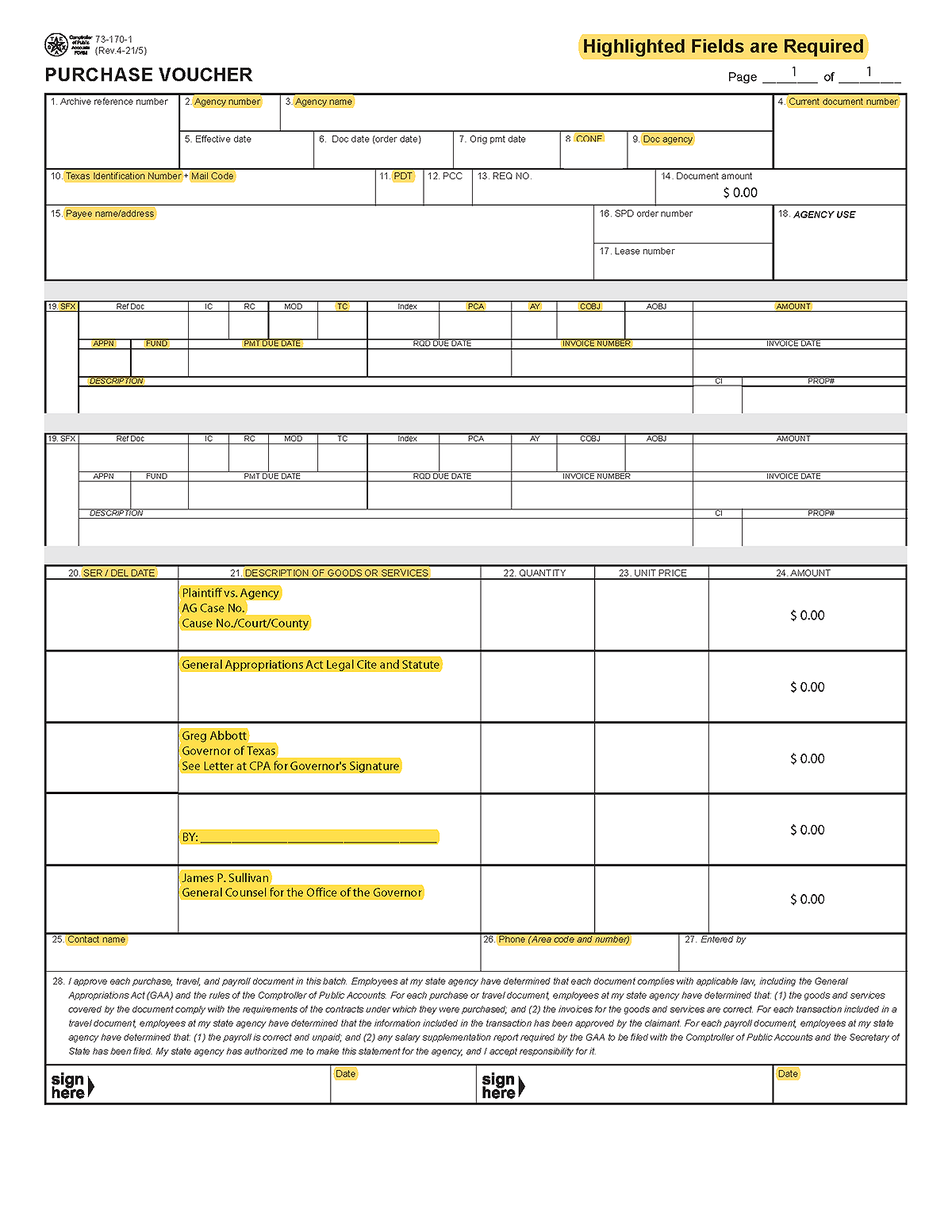

Sample Purchase Voucher

Below is a sample of the purchase voucher. Click or tap the image to enlarge it in a new browser window.

Sample Warrant Distribution Instruction Memo

Below is a sample warrant distribution instruction memo from the paying agency to the Comptroller’s office authorizing the release of warrants to the OAG courier for return to the OAG.

Note: The paying agency’s name must appear on letterhead.

DATE: xx/xx/xxxx

TO: Comptroller’s Office, Fiscal Management Division, Warrant Window

FROM: (Paying Agency)

SUBJECT: Release Warrant(s) To Attorney General Runner For Hand Delivery To

OAG Accounting Office

OAG Accounting: (512) 475-4370 OAG Courier: (512) 305-8770

Fund Amount Agency Voucher # Assistant Attorney General

0001 $1,000.00 ######## Jane DoeSettlement and Judgment Comptroller Objects

- Comptroller object 7221 — Settlements and Judgments — Texas Tort/Pre-Litigation and Related Claims — No Attorney General Approval Required

-

Use this comptroller object to pay pre-litigation claims under Civil Practice and Remedies Code, Chapter 101, 104 or 105; or an eligible medical malpractice claim under Education Code, Chapter 59; or a claim made by the Texas Department of Transportation (TxDOT) pursuant to Transportation Code, Section 201.106.

- Comptroller object 7225 — Settlements and Judgments for Attorney’s Fees

-

Use this comptroller object to record the payment of identifiable attorney’s fees for settlements and judgments recovered against the state under Texas Civil Practice and Remedies Code Annotated, Section 104.003, Federal Court Judgments, medical malpractice claims under Chapter 59, Texas Education Code and other statutes.

Note: Interest associated with judgments is coded separately to ensure proper financial reporting of interest expenses (See comptroller object 7241 in the Comptroller Manual of Accounts).

- Comptroller object 7226 — Settlements and Judgments for Claimant/Plaintiff or Other Legal Expenses

-

Use this comptroller object to record the payment to a claimant or plaintiff for settlements and judgments, or to record payment for other legal expenses (excluding attorney’s fees) that are recovered against the state under Texas Civil Practice and Remedies Code Annotated, Sections 101.023 and 104.003, Federal Court Judgments, medical malpractice claims under Chapter 59, Texas Education Code and other statutes.

Note: Interest associated with judgments is coded separately to ensure proper financial reporting of interest expenses (See Expenditure Code 7241 in the Comptroller Manual of Accounts).

- Comptroller object 7229 — Settlements and Judgments for Claimant/Plaintiff and Attorney

-

Use this comptroller object to record the payment to a claimant or plaintiff and attorney for settlements and judgments recovered against the state under Texas Civil Practice and Remedies Code Annotated, Section 104.003, Federal Court Judgments, medical malpractice claims under Chapter 59, Texas Education Code and other statutes where attorney’s fees cannot be determined because they are included with payment to a claimant or plaintiff.

Payments under this comptroller object may be paid directly to the attorney or law firm identified in the settlement or judgment.

Note: Interest associated with judgments is coded separately to ensure proper financial reporting of interest expenses (See comptroller object 7241 in the Comptroller Manual of Accounts).

- Comptroller object 7241 — Settlement and Judgment Interest

-

Use this comptroller object to record the payment of interest due on long-term debt using governmental or fiduciary funds and to record the payment of other interest expense.

Settlements and Judgments Quick Reference

Overview

The Legislature authorized state agencies to make settlement and judgment payments out of their agency appropriations for causes brought against the state in a federal or state court.

Parties Involved

- The state agency.

- OAG.

- Office of the Governor of Texas.

- Texas Comptroller of Public Accounts.

Limitations

Settlement and judgment payments are limited by the provisions in the GAA, Article IX Section 16.04 and the riders associated with the judgment and settlement line item strategy.

Article IX Limitations:

- The payment of a settlement or judgment may not exceed $250,000 from agency funds.

- The total amount of payments made by an agency for a fiscal year may not exceed 10 percent of the total amount of funds available for expenditure by that agency for that fiscal year.

Article I Limitations:

When a claim exceeds $250,000, the agency pays the first $250,000 and the Comptroller’s office pays the balance — if the claim falls within the appropriation in Article I, Judgments and Settlements.

Claims that do not fall within the settlement and judgment processing guidelines are:

- Inverse condemnation lawsuits (TxDOT Refund and Lawsuit Cost rider).

- Tax lawsuits (agencies should work with their internal legal counsel to determine whether they have authority to process tax refunds).

- All pre-litigation settlements (state agencies not represented by OAG).

State agencies should refer to the GAA, Article IX of for more details.

Sequence of Events

- Plaintiff, plaintiff’s attorney, plaintiff’s insurance company or the OAG may notify a state agency of a claim.

- The OAG sends a letter with examples to the agency advising them to prepare a warrant distribution memo, agency authorization letter and purchase voucher for inclusion in the settlement or judgment package. These instructions and examples are part of the Comptroller’s office payment process.

- Agency submits the warrant distribution memo, agency authorization letter and purchase voucher to the OAG within 10 days of notification.

- OAG prepares and approves the settlement agreement or judgment.

- OAG prepares a transmittal letter addressed to the Comptroller’s office.

- OAG submits the settlement package to the governor for approval.

- The governor approves and sends the settlement or judgment package back to the OAG.

- OAG forwards the package to the Comptroller’s office for payment.

- Comptroller’s office reviews and approves the settlement or judgment package for payment.

- Warrants are issued and returned to attorney general by an OAG courier.

- Total processing time from the time the agency is notified by OAG to prepare necessary documents until a warrant is issued is approximately six to eight weeks.

Documents Required

Settlement or Judgment Package

- Agency authorization letter.

- Warrant distribution memo.

- Purchase document.

- Settlement agreement or judgment.

- Release of claims prepared by OAG attorney.

- Transmittal letter from OAG to the Comptroller’s office.

- Completed Settlement and Judgment Payroll Processing form (74-232) (Payroll only).

Approvals & Signatures

- State agency representative.

- Attorney General.

- Governor.

- Comptroller’s office auditor.

USAS Processing Requirements

- The purchase document should be entered by the paying agency in the USAS as Doc Type 9 (Doc Type 5 for payroll) before forwarding to OAG.

- Applicable 1099 coding should be entered in the appropriate box in USAS for IRS reporting requirements.

- Y, S or N should be entered in the

CONFIDENTIAL INDICATOR (CONF)field in USAS (Y for yes-confidential, S for some-confidential and N for not-confidential). If this field is left blank, it will default to an N (not confidential). - The paying agency balances and releases the batch for USAS processing.

- R should be entered in the

PAYMENT DISTRIBUTION TYPE (PDT)field to ensure a paper warrant is generated. If a PDT other than R is entered in this field, USAS will override the entry and force an R. - Enter 225 (Purchase) or 874, 875, 876, 877 (Payroll) — some of the payroll T-codes may not apply to every payroll settlement/judgment.

- The agency representative who signs the purchase voucher must be listed on the voucher signature card on file with the Comptroller’s office.

- The settlement or judgment must be approved by OAG, and the governor must sign the purchase voucher before the Comptroller’s office can issue payment.

- One or more of the following comptroller objects may be used: 7221, 7225, 7226, 7229, 7241.

Note: Although descriptive legal text is no longer required in USAS, please include the appropriate legal citation for making the payment on the hard copy of the purchase document.

Tracking Your Document

The Unapproved Documents Report (DAFR7700) is monitored daily by an auditor in the Comptroller’s office Expenditure Assistance section of the Fiscal Management Division and is updated with the appropriate action code to identify any problems with the document.

To monitor your document’s progress:

- Refer to the USAS Document Tracking (37) screen to determine the status of a document.

- Refer to the USAS Action Code Profile (D44) screen for definitions of the settlement and judgment action codes 430 - 550.

- Monitor USAS documents for the action codes and for any error messages that may occur and need correcting.

The Comptroller’s auditor will enter a 550 approval code in USAS when:

- The settlement or judgment package is received by the Comptroller’s office.

- Required agencies have approved the settlement or judgment package.

- USAS entry is error-free and properly coded.

Contact

Fiscal Management Division

Expenditure Assistance section

(512) 475-0966

Fax: (512) 475-0588

Email: Settlements.Judgments@cpa.texas.gov

| Date | Updates |

|---|---|

| 01/13/2023 | Updated legal citation for settlements and judgments to be paid from the Comptroller’s Fiscal Programs appropriation and clarified valid USAS document types |

| 07/06/2022 | Added clarifying information to the Processing Instructions for the Payment of Settlements and Judgments, Processing Instructions for the Payment of Settlements and Judgments – Pre-Litigation Settlements and Settlements and Judgments Quick Reference sections |

| 10/12/2021 | Updated the Appropriation Year Determination for Settlements and Judgements section for clarity |

| 04/24/2020 | Added Settlement and Judgment Payroll Processing form, updated legal authority, clarified T-code for payments and added instructions for payroll processing |

| 11/01/2018 | Clarifying language for Purchase/Payroll Voucher submission |

| 08/22/2018 | Added 1099 instructions for payment of attorney fees on COBJ 7221 (Pre-Litigation) and added clarifying language to Transportation Code reference |