A Plan for the Implementation of Enterprise Resource Planning (ERP) for the State of Texas

The ERP Plan

Recommendations

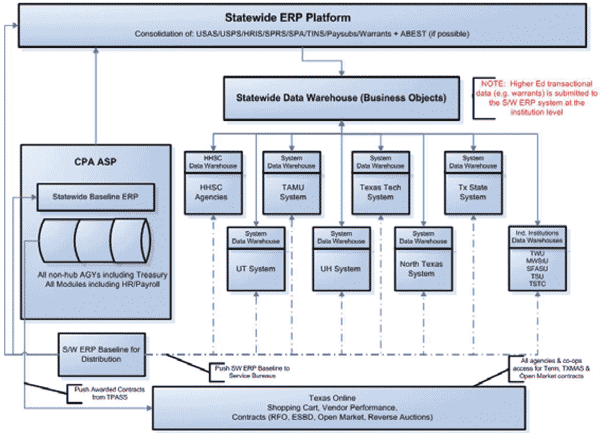

The advisory council recommends that the Comptroller implement BCA 3, the Hub Model, which was presented in the business case analysis prepared by STA and is shown in Figure 2. Under BCA 3, State agencies (with the exception of the Health and Human Services agencies and institutions of higher education) will migrate to a new Statewide ERP platform operated by the Comptroller’s ASP service. The HHS agencies and institutions of higher education would operate under a decentralized processing model as data reporting “hubs.” They would be interfaced into the Statewide Data Warehouse platform and their transactional data would be interfaced into the new ERP system. Should it be determined after requirements analysis that additional Hubs are needed, this model may be expanded. Under this model specific agency/institution transactional systems would be interfaced to the Statewide ERP System for addressing major functional needs such as financial and payment processing. The existing statewide legacy administrative systems (e.g., USAS, USPS, SPA, USPS, SPRS, TINS) will be replaced by the Statewide ERP system that will provide all functionality identified in HB 3106.

BCA 3 – Hub Model Diagram

A separate data warehouse will be established by each higher education system, independent higher education institutions, and by Health and Human Services. Each hub will develop its own data warehouse capability, and every hub component, agency or institution, will be required to provide data to its hub data warehouse. Component institutions in higher education and Health and Human Services will be able to operate and maintain whatever platform and application set they choose with the only restriction being the system data warehouse conforms to the statewide data standards for statewide reporting. Each hub will follow its own business processes as defined by their business requirements and as dictated by their specific application set. The Statewide ERP baseline code will be made available to every hub for its use, if desired, and will be maintained according to the ERP vendor’s recommended schedule.

The advisory council recommends following a planning, development and deployment schedule that postpones the start and completion of the project by approximately one year when compared to the Business Case Study.

We recommend this solution for the following reasons:

- It addresses HB 3106 requirements and the functionality required by the Comptroller’s Rider 16 regarding fleet management.

- It complies with the ERP Advisory Council’s guiding principle of “not throwing out what works” by leveraging the considerable work done to date by Higher Education and Health and Human Services in implementing their own ERP systems.

- The state will achieve business process standardization based on best practices, economies of scale and efficiency gains through the implementation of a single, unified platform for almost all state agencies while still allowing for the differences in the functional requirements of the hubs.

- It provides for significantly enhanced statewide reporting for both higher education and the State agencies, which will greatly facilitate a “single source of the truth” and taxpayer transparency.

- It eliminates the use of SSNs as the primary identifiers in the statewide administrative systems, thus helping to reduce identity theft opportunities.

- It provides for compliance with Section 508 of the Americans with Disabilities Act regarding accessibility.

- It eliminates much of the fragmentation associated with the State’s existing administrative systems environment.

- Total project implementation costs are considerably less than the costs of implementing the alternative ERP scenario (BCA 2) presented by Salvaggio, Teal & Associates (STA) in their business case analysis.

- It is the model most often utilized by other states to meet their statewide administrative system needs, resulting in lower overall project risk.

- It eliminates proliferation of agency ERP and other administrative shadow systems, while allowing higher education to maintain its own ERP solutions that are integrated with other ERP functions such as patient care, student information, learning management and library systems.

- It provides a plan that allows the state to significantly upgrade the functionality and reporting capabilities of its statewide administrative systems and retire the legacy systems (USAS, SPRS, USPS, HRIS, SPA, TINS) over a period of seven years.

- It establishes a common language for reporting expenditures through use of commodity codes (NIGP) and focuses the use of Comptroller Object Codes on financial reporting (ACFR, GASB), thereby allowing for consistent reporting and better analysis of how the State’s money is spent.

- It provides for a statewide procurement system that will be fully-integrated with the financial accounting, asset management, and Inventory management modules, as well as the Online Ordering System currently in development by the Comptroller’s office.

- It provides for better tracking of the state’s assets, thus helping agencies and the Legislature in budget planning by identifying replacement costs and schedules.

- Hubs will gain the benefit of centralized reporting at the system or enterprise level through data warehouses that will be used to gather and normalize disparate institutional data to support effective statewide reporting goals.

- It allows for the hubs to consider ERP consolidations through an evolutionary process, should their existing systems reach the end of their useful lives.

The ERP cost to be funded under BCA 3 is:

Total ERP Project Cost $248,458,000

15% Contingency 37,269,000

Total $285,727,000

This includes costs incurred during the 7-year project timeframe for pre-implementation services, the implementation project, ongoing support costs during this period and the contingency. These are the costs that would be considered “new funding” until the Comptroller is able to retire the existing statewide administrative systems. The following table provides cost categories by fiscal year for recommended BCA 3 (net of the 15 percent contingency).

The Assumptions provided in the ERP Advisory Council’s Plan are very important to the recommendations regarding BCA 3. Changes to any of the Assumptions or any future negotiations with vendors may materially impact the project’s timeline, cost, scope, resources and expectations.

| Cost Category | Fiscal Year | |||||||

|---|---|---|---|---|---|---|---|---|

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | Total | |

| Total Project Costs | $1,805 | $41,339 | $41,860 | $22,883 | $29,668 | $12,817 | $16,147 | $166,519 |

| Total Operations Costs | $3,400 | $3,502 | $14,529 | $15,255 | $15,794 | $29,459 | $81,939 | |

| Contingency (15 percent) | $37,269 | $37,269 | ||||||

| Total Annual ERP Cost | $39,074 | $44,739 | $45,362 | $37,412 | $44,923 | $28,611 | $45,606 | $285,726 |

| Cumulative ERP Cost | $39,074 | $83,813 | $129,175 | $166,587 | $211,510 | $240,121 | $285,726 | |

Contingency Requirements and Utilization Management

The advisory council has recommended that a contingency amount be reserved equal to 15 percent of the total estimated project to address unforeseen costs and/or costs that could not adequately be addressed as part of the STA study due to specific information not being available at the time the study was performed. The contingency would also cover costs associated with the Advisory Council’s recommendation to postpone the start of the project until the beginning of fiscal year 2010 and complete the project during fiscal year 2016.

The advisory council recommends that the Comptroller’s Office manage any activities that potentially impact contingency funding based on direction provided by a new ERP project oversight committee. Any requests to utilize the contingency funding should be initiated through the execution of a formal contingency use request process.

Recommended Deployment Phasing

The advisory council recommends that the phased deployment by agency group approach in the Study be utilized for deployment of the ERP solution across State government. Using this approach, state agencies would be logically organized into multiple deployment groups or “waves,” as suggested below:

| Fiscal Year | Activity |

|---|---|

| FY10/11 | Planning; statewide ERP requirements development; procurement of ERP software and integration services; contingency established; develop ERP blueprint |

| FY12/13 | 32 Agency deployments |

| FY14/15 | 92 Agency deployments; replace statewide system; hub interfaces completed |

| FY16 | 11 Agency deployments; replace remaining statewide systems; software upgrade |

ERP Software Considerations

The advisory council recommends that the state evaluate all relevant ERP software options to achieve best value for the state of Texas. The recommended BCA 3 will allow for maximum flexibility for the state of Texas, which includes the diversity across the hubs in their software and business processes.

Given the current Texas software environment there may be cost savings and benefits associated with utilizing PeopleSoft for the statewide ERP solution.

Complexities Associated with Higher Education

HB 3106 required that institutions of higher education be included in the Statewide ERP Plan. The recommended BCA 3 requires that each higher education system operate as a reporting entity and interface directly into the Statewide Data Warehouse that will be operated by the Comptroller ASP service. Institution transactional systems will be interfaced to the Statewide ERP System for addressing major business processes at the statewide level.

Caution should be exercised regarding any future statewide ERP plans that require institutions of higher education to move to a common ERP solution for the following reasons:

- The focus of state government ERP implementations is typically on financial management and human resources/payroll functionality. Higher Education implements these modules but also student information, financial aid, library, and learning management modules to meet the administrative business process needs of their students, faculty, and staff. Selection of student information, financial aid, library, and learning management systems is often driven by institutional size, program scope and complexity. At times, a “best-of-breed” approach may be appropriate with functional integration of ERP modules being the requisite requirement.

- While a “one-size-fits-all” approach (with limited exceptions) is feasible for State agencies participating in a statewide ERP project, such an approach will not work for higher education without providing for considerable unique configuration for health-related components and large flagship academic institutions. Additional complications arise because most institutions have student and other academic systems that share tables with their existing ERP systems (e.g., student billing and receivables maintained in current financial management systems are required to interact with student information and financial aid systems). These additional complexities would add considerable costs and risks to the statewide ERP Project.

- Considerable effort and funding has been expended to date by the State’s institutions of higher education to move to ERP systems to address their financial management, human resources/payroll, student information, financial aid, and other administrative business process needs.

Research provided by the National Association of State Auditors, Comptrollers, and Treasurers (NASACT), and cited by STA, validated that only the State of North Dakota utilizes a model whereby state government and higher education operate under the same ERP system.

Integration Challenge

While the advisory council supports the concept of full integration to the maximum extent possible, there are instances in which integration challenges arise as the state may best meet a specific business need through the use of a “best-of-breed” software product. A “best-of-breed” approach means that the state would choose the best software product available for a specific business function and then build the necessary interfacing “points” between that system and the statewide ERP system. STA suggested that the state may want to research alternative “bestof- breed” solutions for the following functional areas prior to committing to an ERP product line for all functionality identified under HB 3106 and Rider 16:

- Fleet Management – a specific business need that is typically addressed through the acquisition of a “best-of-breed” solution that is then interfaced with the statewide ERP system. Best-of-breed fleet management software is typically more robust and feature-rich than the solutions offered by the major ERP vendors; they are also more reasonably-priced.

- Time and Labor – The Comptroller must ensure that the time and labor module will meet all time reporting requirements prior to committing to its use as the statewide ERP solution for state government time reporting.

- Budget Development – Based on the research done by STA, most state and local governments

utilize one of the following solutions for developing their enterprise budgets:

- Custom-developed software;

- Personal computer spreadsheets;

- Best-of-breed budget development software; or

- Budget development module within ERP software.

Most of STA’s state and local governmental clients have chosen not to purchase the budget development module after a thorough evaluation of the software’s capabilities.

As with time and labor, the Comptroller needs to analyze whether the budget development module(s) will meet specific appropriation, operating, capital, and other budget development requirements before committing to its use as the statewide ERP solution for state government budget development.

Funding Options

As discussed previously, the ERP cost to be funded is $285,727,000 ($248,458,000 plus 15 percent contingency of $37,269,000). This includes costs incurred over the seven-year project timeframe for pre-implementation services, the implementation project, ongoing support costs during this period and the contingency. These are the costs that will require additional appropriations until the Comptroller is able to retire the existing statewide administrative systems.

Although the costs associated with implementing ERP will be significant, the advisory council believes there is a compelling business case for the state to proceed with implementation of a new statewide ERP system.

There are two primary considerations for ERP system funding models:

- Should debt financing, new state appropriations, or some combination of the two be used to pay ERP implementation costs?

- Should the ERP costs be appropriated to a central authority, be allocated to individual agencies, or some combination of the two?

It is the Advisory Council’s recommendation that additional funds be appropriated to the Comptroller to fund the ERP costs. Additional information concerning the funding options can be found in the Funding Plan section of the Study.

Estimated Method of Finance

Although the Advisory Council’s recommendation is for general revenue appropriation to the Comptroller, a portion of the general revenue appropriation will be offset by federal and other state funds through the use of the statewide cost allocation plan (SWCAP). Of the approximate $285.7 million proposed project budget, the estimated costs to the various funding sources are as follows:

- $142.9 million general revenue

- $18.7 million general revenue dedicated

- $78.2 million federal funds

- 45.9 million other funds