Deposit of Sales Taxes Collected by State Agencies (APS 008)

Issued: Nov. 22, 2005

Updated: Aug. 15, 2025 — View Changes

Details

Resources

- City Sales and Use Tax local codes

- County Sales and Use Tax local codes

- Local Sales and Use Taxes

- SPD Sales and Use Tax local codes

- Transit Sales and Use Tax local codes

- Combined Area Sales and Use Tax

Contact

For questions on:

- The taxing authority vendor number profile at the agency level.

- Deposits, documents or transaction entry.

- Sales tax permits.

Email or call Gina Schildwachter at (512) 936-5999 of the Statewide Fiscal Programs section.

For questions on:

- Sales tax, including tax rates.

- Taxability of items.

Contact the Comptroller’s Tax Assistance section of Telephone Bank Operations at (512) 463-4600 or (800) 531-5441, ext. 3-4600.

CAPPS

For CAPPS questions, contact your agency’s CAPPS support staff.

Authorized agency support staff may contact the CAPPS Service Desk at (512) 463-2277 for additional assistance.

Overview

Applicable To

State agencies and institutions of higher education

Policy

State agencies and institutions of higher education must collect all applicable sales taxes (state, city, transit authority, county and special purpose district) when making sales to the public.

Legal Citation

Tax Code, Sections 151.051–058, 151.101–107, 151.423, 321.101–107, 322.101–106, 322.108–110, 323.101–105, 325.021–023; Government Code, Section 404.094; Education Code, Section 51.002 and 51.008; Transportation Code, Sections 451.205, 451.404–405, 452.401–407, 453.401–404.

Legend

This icon indicates information applicable to the Centralized Accounting and Payroll/Personnel System (CAPPS).

Background

Introduction

State agencies must collect all applicable sales taxes — state, city, transit authority, county, combined and Special Purpose District (SPD) — when making sales to the public. These taxes must be deposited into the state treasury within three business days of receipt as provided by Government Code, Section 404.094, or within seven business days of receipt as provided by Education Code, Section 51.008. The Table of Taxable Items included in this accounting policy statement (APS) provides examples of items commonly sold by state agencies.

State Agencies Must Comply With Tax Code

Attorney General Opinion JM-987 (Nov. 30, 1988) concluded that state agencies are required to follow sales tax provisions in the Tax Code. This includes obtaining and displaying a sales tax permit and filing a sales tax return.

Agencies Are Eligible for Tax Discounts

As state agencies must comply with the sales tax laws, agencies are therefore eligible for sales tax discounts. The discount is 1/2 of 1 percent of the total sales taxes collected and is applicable for timely payments or deposits.

Institutions of higher education that collect sales tax generated by educational activities, research or demonstrations authorized by Education Code, Section 51.002 and 51.008, may retain the sales tax discount under Tax Code, Section 151.423, in their local banks.

State agencies must have specific appropriation authority to spend the discount. Otherwise, agencies must deposit the discount into unappropriated General Revenue, Appropriation 99906.

Depositing Taxes

Taxes must be deposited as follows:

- State sales tax is deposited into the General Revenue fund, Appropriated Fund 0001.

- Local sales taxes (city, transit authority, county, combined and SPD) are deposited into the City, Metropolitan Transit Authority (MTA), County and SPD Sales Tax Trust, Appropriated Fund 0882, for allocation to the local taxing authorities. Special purpose district sales taxes are governed by Tax Code, Chapter 323; therefore, they are accounted for as county sales taxes. Before an agency can record local sales activity, the local taxing authority vendor number must be profiled in the agency’s Uniform Statewide Accounting System (USAS) Vendor Profile (34) screen.

Entering Deposit Transactions in USAS

Agencies must enter their deposit transactions in USAS. The USAS transaction records will serve as the agencies’ tax information. The Comptroller’s office will accumulate the sales tax data, as entered in USAS, and prepare monthly sales tax returns for all state agencies. A separate sales tax return form is not required to be filed by the individual agency.

Filing Tax Returns

Sales tax forms used by businesses to report sales tax collections are sent to the Comptroller’s Revenue Processing Division monthly, quarterly or annually. The collections reported are credited to the business’ taxpayer number or federal employer identification number.

This process can be used in lieu of the USAS entries described in this accounting policy statement. For more information, contact the Webfile help desk at (800) 442-3453.

Recap of Comptroller Requirements

The Comptroller’s Fiscal Management Division will designate the following for tax deposits:

- Appropriated fund.

- Generally accepted accounting principles (GAAP) fund.

- GAAP fund type.

- Appropriation number.

- Comptroller object.

- Program code.

- T-code for recording in USAS the deposit of sales tax in the state treasury.

The Comptroller’s Revenue Accounting Division will prepare a monthly local sales tax return for all state agencies.

The Comptroller’s Enforcement Division will assist agencies in:

- Determining permitting needs.

- Obtaining sales tax permits.

- Answering specific tax-related questions.

Recap of Agency Requirements

Agencies must obtain and display a sales tax permit. In addition, agencies must establish the necessary USAS profiles to correctly record in USAS the deposit of sales tax into the state treasury. When new taxing authorities require collections, agencies must contact the Comptroller’s office to establish a Taxing Authority Vendor Number in USAS. Follow these procedures in setting up USAS profiles:

- Agencies establish the D23 profile fund (Fund 1000) that looks up Appropriated Fund 0001, GAAP Fund 0001 and GAAP Fund Type 01.

- Agencies establish the D23 profile fund that looks up Appropriated Fund 0882, GAAP Fund 0001 and GAAP Fund Type 01.

- Universities establish the D23 profile fund that looks up Appropriated Fund 0001, GAAP Fund 0001 and GAAP Fund Type 05.

- Universities establish the D23 profile fund that looks up Appropriated Fund 0882, the GAAP Fund with their assigned ACFR File ID contained in the D24 GAAP Fund profile and GAAP Fund Type 05.

- On the Program Code Profile (DØ4), use Program Code 3992 or an appropriately defined program code that looks up Program Code 3992 for both Fund 0001 and 0882.

- On the Program Cost Account Profile (26), use Program Cost Account (PCA) 99906 for Fund 1000 and PCA 99907 for Fund 0882.

Sales Tax

Introduction

Under Government Code, Section 404.094(a), state agencies that collect sales taxes (state, city, county, MTA, combined and SPD) must deposit them in the state treasury within three business days of receipt or within seven days if an institution of higher education as provided by Education Code, Section 51.008.

Agencies must enter deposit documents in USAS and transmit the money to the state treasury with a deposit slip. Copies of deposit documents are not required.

Types of Sales Tax

State

The state sales tax of 6.25 percent must be collected. The amount collected, less the sales tax discount, must be deposited into an agency’s D23 profile fund.

City

If taxable sales are made in a city that has adopted a city sales tax, the additional tax must be collected. The tax collected, less the sales tax discount, must be deposited into an agency’s D23 profile fund.

MTA

Calculate transit authority sales tax rates using the processes in this table.

| If taxable sales are made in… | Then… |

|---|---|

| An area where the MTA tax has been levied | additional tax must be collected at the rate in effect in that area |

| Incorporated cities with a population of 56,000 or more that are operating a mass transportation system and have adopted a city mass transit department (CTD) tax | additional tax must be collected at the rate in effect in those cities |

The amount collected, less the sales tax discount, must be deposited into an agency’s D23 profile fund.

County and Special Purpose District

If taxable sales are made in a county or special purpose district which has adopted a sales and use tax, additional tax must be collected at the rate in effect in that county or district. The amount collected less the discount must be deposited into an agency’s D23 profile fund.

Vendor Number/Mail Code and Taxing Authority Name Required for Local Sales Tax

To ensure that city, MTA, county and special purpose district sales tax transactions (deposits, corrections, returned checks and refunds) process correctly in USAS, the following information must be entered in the USAS transaction record.

- The local jurisdiction information number: Enter in the

VENDOR NUMBER/MAIL CODEfield. - The taxing authority’s name: Enter in the

DESCRIPTIONfield.

The local jurisdiction information number begins with a zero followed by the seven-digit local code and six zeroes. For example, the number for the city of Abbott is 02109064000000.

The local code for each taxing authority begins with a specific number:

- Cities start with a 2.

- Transit authorities start with a 3.

- Counties start with a 4.

- SPDs start with a 5.

- Combined areas start with a 6.

USAS Coding Information for Sales Tax Deposits

For the following types of sales tax deposits in USAS, refer to the coding blocks below and use document type D, batch type 2.

State

| Fund | PCA | T-code | Appropriation Number | COBJ |

|---|---|---|---|---|

| 0001 | 99906 | 188 | 99906 | 3103 |

City

| Fund | PCA | T-code | Appropriation Number | COBJ |

|---|---|---|---|---|

| 0882 | 99907 | 188 | 99907 | 3790 |

MTA

| Fund | PCA | T-code | Appropriation Number | COBJ |

|---|---|---|---|---|

| 0882 | 99907 | 188 | 99907 | 3790 |

County/Special Purpose/Combined

| Fund | PCA | T-code | Appropriation Number | COBJ |

|---|---|---|---|---|

| 0882 | 99907 | 188 | 99907 | 3790 |

USAS Coding Information for Sales Tax Discounts

Sales tax discounts (1/2 of 1 percent of the total sales taxes collected) must be deposited into the state treasury as unappropriated receipts unless specific authority exists to deposit and spend the funds locally.

Agencies must calculate and deposit sales tax discounts at the time of the original sales tax deposit due to the monthly sweep of the City, MTA, County and SPD Sales Tax Trust, Appropriated Fund 0882.

For sales tax discounts in USAS, refer to the coding block below and use document type D, batch type 2:

| Fund | PCA | T-code | Appropriation Number | COBJ |

|---|---|---|---|---|

| 0001 | 99906 | 188 | 99906 | 3105 |

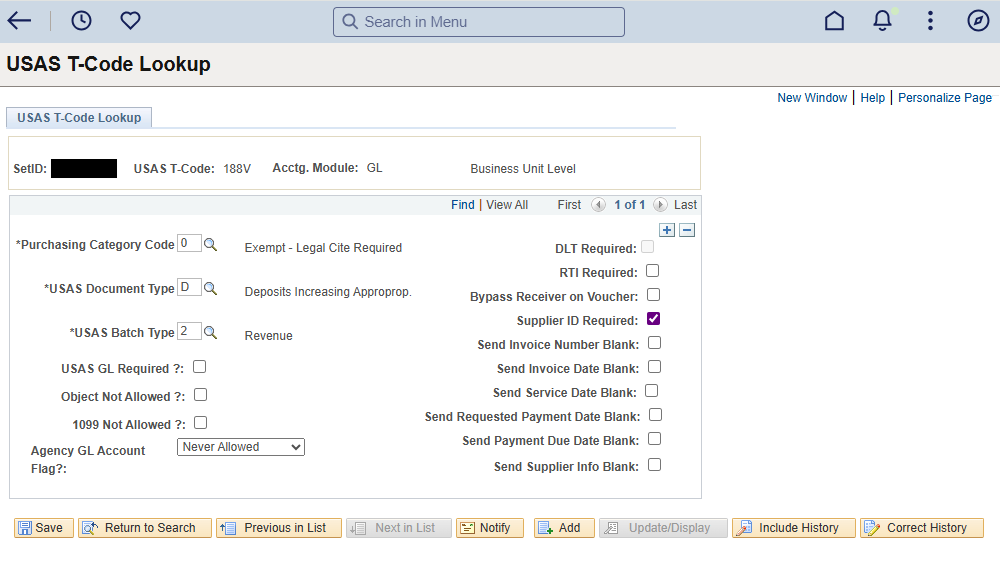

CAPPS agencies can process a sales tax deposit in CAPPS using a General Ledger journal with a Vendor ID. The Vendor ID must be the first 14 characters of the journal line description. CAPPS agencies will need to update the Vendor ID in USAS to include the check digit that is calculated in CAPPS. Agencies will need to create a 188V T-code in the USAS T-code Lookup (Navigation: Main Menu | CAPPS Statewide | Statewide Setup | USAS T-Code Lookup) to allow the Vendor ID to be validated in the journal (see below).

Corrections to Sales Tax Deposits

Follow these steps to make corrections to state and local sales tax deposits:

| Step | Action |

|---|---|

| 1 | Make the corrections on a journal voucher, document type J, batch type 2. |

| 2 | Reverse the original transaction with T-code 188R. |

| 3 | Enter a new transaction using T-code 188 with the correct coding block and taxing authority information. |

USAS Coding Information for Returned Checks

| Fund | PCA | T-code | Appropriation Number | COBJ |

|---|---|---|---|---|

| 9001 | 99901 | 153R | 00000 | 3789 |

After the default fund has been cleared, the taxes should be posted using the appropriate coding block below.

State

| Fund | PCA | T-code | Appropriation Number |

|---|---|---|---|

| 0001 | 99906 | 156 | 99906 |

Local

| Fund | PCA | T-code | Appropriation Number |

|---|---|---|---|

| 0882 | 99907 | 156 | 99907 |

For each taxing authority reported, include the local tax authority vendor number.

Refunding State and Local Sales Tax

Follow these steps to refund sales taxes:

| Step | State sales tax | Local sales tax |

|---|---|---|

| 1 | Process a journal voucher, document type J, to reverse the refundable amounts out of the coding blocks and taxing authorities to which the taxes were originally recorded in USAS. | |

| 2 | Reverse state sales tax out of:

|

Reverse city, county, MTA, combined and SPD sales tax out of:

|

| 3 | Put those taxes into the agency’s suspense account, D23 profile Fund 0900, GAAP Fund 0001, GAAP Fund Type 01). | |

| 4 | Use T-code 188R, COBJ 3103 to reverse the state tax out of Appropriated Fund 0001 and T-code 188, COBJ 3790 to put the tax into Appropriated Fund 0900. | Use T-code 188R, COBJ 3790 to reverse each local tax out of Appropriated Fund 0882 and T-code 188, COBJ 3790 to put the tax into Appropriated Fund 0900. |

Note: The refund payment from the agency’s suspense account, D23 profile Fund 0900 should be entered in USAS using T-code 229 and COBJ 3790. The vendor number/mail code required will be that of the payee receiving the tax refund.

CAPPS agencies that need to make corrections to sales tax deposits should follow the USAS instructions above and enter the transactions directly in USAS. Then, a manual T-code journal can be entered into CAPPS to match the USAS entry.

Table of Taxable Items

Introduction

The following table lists examples of taxable items commonly sold by state agencies.

Table of Taxable Items

Use this table to determine whether sales may be subject to sales tax or exempt:

| Category | Item | Taxable | Exempt |

|---|---|---|---|

| Sales by agencies to out-of-state purchasers | Possession takes place in Texas | X | |

| Possession takes place outside Texas (e.g., mail order sales) | X | ||

| Sales of surplus property | To non-state purchasers (a) typewriters, office furniture, construction equipment and other tangible, personal property Note: You may accept a resale certificate in lieu of collecting sales tax on sales to a retailer that will resell these items. |

X | |

| (b) vehicles licensed for use on highways (subject only to the Motor Vehicle Sales Tax which is collected by the county Tax Assessor-Collectors) | X | ||

| To state agencies | X | ||

| Sales of government publications and records | Single copy of any document that a governmental body is required to furnish pursuant to Texas Government Code Annotated, Chapter 552 (Open Records Act) regardless of whether or not the copy is certified or whether the copy fee is set by statute or by governmental body. This includes reports or information that must be compiled pursuant to a specific request or inquiry (e.g., lists, special reports, computer tape reports, microfiche, audio-cassette duplication, blue-line copies and other items or records not fitting the category of a publication). | X | |

| Additional copies to the same party in the same request | X | ||

| Copy or copies of documents that are not open to public inspection provided to an authorized party (e.g., birth certificate) | X | ||

| Regular publications by a governmental body of records or general information even though such records or information may be open or available to the public by statute (including topographic maps and other enlarged maps) | X | ||

| Sales of other publications | Publications that meet the definition of a newspaper | X | |

| Magazines sold on a semiannual or longer subscription basis and mailed second-class | X | ||

| Individual magazine sales | X | ||

| Transportation and delivery/handling charges on taxable items | Handling charges | X | |

| U.S. postage and handling charges (stated together) | X | ||

| U.S. postage (stated separately for mailing to buyer) | X | ||

| U.S. postage (stated separately for mailing to third-party at buyer’s request) | X | ||

| Transportation/delivery charges other than U.S. postage (e.g., UPS or Yellow Freight) | X | ||

| Sales of food for immediate consumption | Meals and food sold by schools other than colleges and universities | X | |

| Meals and food sold by colleges and universities | X | ||

| Bottled water, not flavored, sold by colleges and universities | X | ||

| Meals served by hospitals and other institutions licensed by the state for the care of human beings: | |||

| (a) to patients or inmates Note: Effective Oct. 1, 1995, sales tax is due on meals, soft drinks, and candy sold to inmates of correctional facilities operated under the authority of, or under contract with, the state of Texas or a political subdivision of the state. |

X | ||

| (b) to visitors or employees | X | ||

| Sale of data processing services | Word processing, data entry, data retrieval, data search, information compilation, payroll and business accounting data production and other information storage or manipulation: | ||

| (a) for individuals (first 20 percent of sale is exempt) | X | ||

| (b) for state agencies | X | ||

| Use of computer or computer time for data processing: | |||

| (a) by individuals (first 20 percent of sale is exempt) | X | ||

| (b) by state agencies | X | ||

| Sale of information services | Furnishing general information: | ||

| (a) to individuals and most private businesses (first 20 percent of sale is exempt) | X | ||

| (b) to state agencies | X | ||

| (c) to newspaper of general circulation published at least weekly or to radio or TV stations licensed by FCC | X | ||

| Date | Updates |

|---|---|

| 08/15/2025 | No changes through acts of the 89th Legislature, Regular Session |

| 08/18/2023 | No changes through acts of the 88th Legislature, Regular Session; updated contact information |

| 08/20/2021 | Updated to reflect changes required through the implementation of GASB 84 |