Deposit of Sales Taxes Collected by State Agencies (APS 008)

Sales Tax

Introduction

Under Government Code, Section 404.094(a), state agencies that collect sales taxes (state, city, county, MTA, combined and SPD) must deposit them in the state treasury within three business days of receipt or within seven days if an institution of higher education as provided by Education Code, Section 51.008.

Agencies must enter deposit documents in USAS and transmit the money to the state treasury with a deposit slip. Copies of deposit documents are not required.

Types of Sales Tax

State

The state sales tax of 6.25 percent must be collected. The amount collected, less the sales tax discount, must be deposited into an agency’s D23 profile fund.

City

If taxable sales are made in a city that has adopted a city sales tax, the additional tax must be collected. The tax collected, less the sales tax discount, must be deposited into an agency’s D23 profile fund.

MTA

Calculate transit authority sales tax rates using the processes in this table.

| If taxable sales are made in… | Then… |

|---|---|

| An area where the MTA tax has been levied | additional tax must be collected at the rate in effect in that area |

| Incorporated cities with a population of 56,000 or more that are operating a mass transportation system and have adopted a city mass transit department (CTD) tax | additional tax must be collected at the rate in effect in those cities |

The amount collected, less the sales tax discount, must be deposited into an agency’s D23 profile fund.

County and Special Purpose District

If taxable sales are made in a county or special purpose district which has adopted a sales and use tax, additional tax must be collected at the rate in effect in that county or district. The amount collected less the discount must be deposited into an agency’s D23 profile fund.

Vendor Number/Mail Code and Taxing Authority Name Required for Local Sales Tax

To ensure that city, MTA, county and special purpose district sales tax transactions (deposits, corrections, returned checks and refunds) process correctly in USAS, the following information must be entered in the USAS transaction record.

- The local jurisdiction information number: Enter in the

VENDOR NUMBER/MAIL CODEfield. - The taxing authority’s name: Enter in the

DESCRIPTIONfield.

The local jurisdiction information number begins with a zero followed by the seven-digit local code and six zeroes. For example, the number for the city of Abbott is 02109064000000.

The local code for each taxing authority begins with a specific number:

- Cities start with a 2.

- Transit authorities start with a 3.

- Counties start with a 4.

- SPDs start with a 5.

- Combined areas start with a 6.

USAS Coding Information for Sales Tax Deposits

For the following types of sales tax deposits in USAS, refer to the coding blocks below and use document type D, batch type 2.

State

| Fund | PCA | T-code | Appropriation Number | COBJ |

|---|---|---|---|---|

| 0001 | 99906 | 188 | 99906 | 3103 |

City

| Fund | PCA | T-code | Appropriation Number | COBJ |

|---|---|---|---|---|

| 0882 | 99907 | 188 | 99907 | 3790 |

MTA

| Fund | PCA | T-code | Appropriation Number | COBJ |

|---|---|---|---|---|

| 0882 | 99907 | 188 | 99907 | 3790 |

County/Special Purpose/Combined

| Fund | PCA | T-code | Appropriation Number | COBJ |

|---|---|---|---|---|

| 0882 | 99907 | 188 | 99907 | 3790 |

USAS Coding Information for Sales Tax Discounts

Sales tax discounts (1/2 of 1 percent of the total sales taxes collected) must be deposited into the state treasury as unappropriated receipts unless specific authority exists to deposit and spend the funds locally.

Agencies must calculate and deposit sales tax discounts at the time of the original sales tax deposit due to the monthly sweep of the City, MTA, County and SPD Sales Tax Trust, Appropriated Fund 0882.

For sales tax discounts in USAS, refer to the coding block below and use document type D, batch type 2:

| Fund | PCA | T-code | Appropriation Number | COBJ |

|---|---|---|---|---|

| 0001 | 99906 | 188 | 99906 | 3105 |

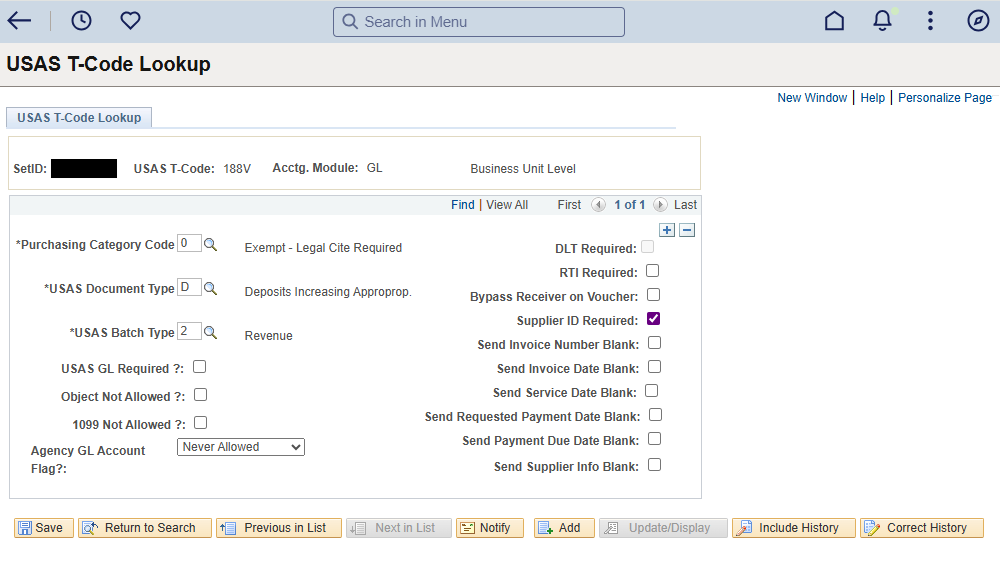

CAPPS agencies can process a sales tax deposit in CAPPS using a General Ledger journal with a Vendor ID. The Vendor ID must be the first 14 characters of the journal line description. CAPPS agencies will need to update the Vendor ID in USAS to include the check digit that is calculated in CAPPS. Agencies will need to create a 188V T-code in the USAS T-code Lookup (Navigation: Main Menu | CAPPS Statewide | Statewide Setup | USAS T-Code Lookup) to allow the Vendor ID to be validated in the journal (see below).

Corrections to Sales Tax Deposits

Follow these steps to make corrections to state and local sales tax deposits:

| Step | Action |

|---|---|

| 1 | Make the corrections on a journal voucher, document type J, batch type 2. |

| 2 | Reverse the original transaction with T-code 188R. |

| 3 | Enter a new transaction using T-code 188 with the correct coding block and taxing authority information. |

USAS Coding Information for Returned Checks

| Fund | PCA | T-code | Appropriation Number | COBJ |

|---|---|---|---|---|

| 9001 | 99901 | 153R | 00000 | 3789 |

After the default fund has been cleared, the taxes should be posted using the appropriate coding block below.

State

| Fund | PCA | T-code | Appropriation Number |

|---|---|---|---|

| 0001 | 99906 | 156 | 99906 |

Local

| Fund | PCA | T-code | Appropriation Number |

|---|---|---|---|

| 0882 | 99907 | 156 | 99907 |

For each taxing authority reported, include the local tax authority vendor number.

Refunding State and Local Sales Tax

Follow these steps to refund sales taxes:

| Step | State sales tax | Local sales tax |

|---|---|---|

| 1 | Process a journal voucher, document type J, to reverse the refundable amounts out of the coding blocks and taxing authorities to which the taxes were originally recorded in USAS. | |

| 2 | Reverse state sales tax out of:

|

Reverse city, county, MTA, combined and SPD sales tax out of:

|

| 3 | Put those taxes into the agency’s suspense account, D23 profile Fund 0900, GAAP Fund 0001, GAAP Fund Type 01). | |

| 4 | Use T-code 188R, COBJ 3103 to reverse the state tax out of Appropriated Fund 0001 and T-code 188, COBJ 3790 to put the tax into Appropriated Fund 0900. | Use T-code 188R, COBJ 3790 to reverse each local tax out of Appropriated Fund 0882 and T-code 188, COBJ 3790 to put the tax into Appropriated Fund 0900. |

Note: The refund payment from the agency’s suspense account, D23 profile Fund 0900 should be entered in USAS using T-code 229 and COBJ 3790. The vendor number/mail code required will be that of the payee receiving the tax refund.

CAPPS agencies that need to make corrections to sales tax deposits should follow the USAS instructions above and enter the transactions directly in USAS. Then, a manual T-code journal can be entered into CAPPS to match the USAS entry.