Accounting Policy Meeting

Wednesday, May 14, 2025

Agenda

| Time | Topic | Speaker |

|---|---|---|

| 10–10:05 a.m. | Welcome and Introductions | Kevin Muir, appropriation control officer, Fiscal Management Division, Texas Comptroller of Public Accounts |

| 10:05–10:30 a.m. | Profile Rollover | Megan Toliver, financial reporting assistant supervisor and Shaun Mendez, appropriation control officer, Fiscal Management Division, Texas Comptroller of Public Accounts |

| 10:30–11 a.m. | Update on GR Reconciliation Process | Megan Toliver, financial reporting assistance supervisor, Fiscal Management Division, Texas Comptroller of Public Accounts |

| 11–11:30 a.m. | GASB 101, Compensable Leave | Lisa Parks, financial reporting team lead, Fiscal Management Division, Texas Comptroller of Public Accounts |

| 11:30–11:55 a.m. | Questions | Financial Reporting and Appropriation Control sections, Fiscal Management Division, Texas Comptroller of Public Accounts |

| 11:55 a.m.–Noon | Adjourn | Kevin Muir, appropriation control officer, Fiscal Management Division, Texas Comptroller of Public Accounts |

Attendees can choose to attend the May 14 (10 a.m.–Noon CDT) one of two ways:

-

Attend in person at:

REJ Conference Center

1501 N. Congress Ave.

Central Conference Room

(N.E. corner of 15th Street and N. Congress Ave.) -

Attend online by:

Registering for the May 14 Financial Reporting Updates webinar (via Webex). After registering, you will receive a confirmation email containing information about joining the webinar.Tips to Follow During the Webinar

- Use Google Chrome as the internet browser to avoid Webex connectivity issues.

- If you lose the connection to the webinar while it is in progress, find your registration confirmation email and click the link to join the webinar again. The presentation should resume in progress.

- If you are using a web browser with multiple tab functionality, open a new window with only a single tab to ensure you do not have multiple sessions open.

To End the Webinar

At the end of the presentation, the moderator will end the webinar. Close your web browser when the webinar is over.

CPE Credit

At this time, no CPE Credit is offered.

Contacts

If you have questions about the webinar, email the Financial Reporting section.

Parking

Visit Capitol Complex Parking and Special Events for more information.

Questions and Answers

Web Applications and Ad Hoc Reports

The AFR Ad Hoc Review Reports are electronically transmitted via secure file transfer protocol (SFTP) from Sept. 2 through Nov. 20.

Agencies may save or print their reports daily, Monday through Friday. Each day’s information is replaced on the following business day by the next transmission.

All Annual Financial Report (AFR) web applications will open for data entry on July 1. This includes Schedule of Expenditures of Federal Awards (SEFA) and State Pass-Through Reporting (SPTR) for federal expenditure activity and state pass-through funds, respectively.

GR Reconciliation

The Financial Reporting section is responsible for processing GR Reconciliation-related USAS entries on behalf of GR consolidated reporting agencies (GCAs). The Financial Reporting section provides documentation to the GCA to support adjustments after completion.

Full reporting agencies (FRAs) are responsible for making their own GR reconciliation-related USAS entries. The Financial Reporting section will not make any adjustments to an FRA’s USAS balances without prior communication. The Financial Reporting section will provide supporting documentation to FRAs for any required adjusting entries impacting their USAS balances.

Yes. The Financial Reporting section sends each agency a copy of any USAS journal entries recorded on its behalf. As necessary, agencies should update their internal accounting system records to realign with their final USAS balances.

Effective fiscal 2024, the GR reconciliation information was moved from AFR’s GR Reconciliation web application to Workiva, which is a reporting tool used by the Financial Reporting section. Consequently, the GR Reconciliation web application is no longer available and does not require official certification. However, the GR reconciliation report is still available and is provided on a weekly basis by the Financial Reporting section (via email) in Excel format.

Even though the GR Reconciliation web application is no longer available for certification, the GR reconciliation worksheet for each agency must be balanced. Each agency’s assigned financial reporting analyst and appropriation control officer coordinates with the agency to process the USAS entries necessary to achieve a balanced GR reconciliation worksheet.

Note: In the ANRC web application, agencies are required to complete the USAS Certification. Under Section I. USAS Reconciliation, the statement contains text related to the validation of the GR reconciliation balances.

Yes. Each agency must continue to work with their assigned appropriation control officer (ACO) to return or draw payroll benefits in USAS.

Note: ACOs make the benefit entries for all GR consolidated reporting agencies (GCAs). The benefits are returned on the last day of the current fiscal year and are put back on the first day of the new fiscal year within the appropriate AY. This allows GCAs a seamless continuity of operations (without interruption) while abiding by state reporting requirements.

Agencies must return payroll benefits by Oct. 31, 2025 (preferably by Oct. 1, 2025).

As per state statute, agencies must transfer unappropriated cash to agency 902 before Aug. 31, 2025.

The GR reconciliation process has not changed. As of fiscal 2024, the GR reconciliation information was moved from AFR’s GR Reconciliation web application to Workiva. The calculation methodology is still the same as it was in prior years. Most of the GR reconciliation fields are automatically populated from USAS and tie to amounts displayed on the GR reconciliation reports, (referring to the Ad Hoc Review Reports with names that begin with “GR”).

Effective fiscal 2025, the GR reconciliation workbooks are distributed to all agencies and university systems on a weekly basis (each Monday) by the Financial Reporting section (via email) in Excel format. The Excel workbook consists of two worksheets:

- GR Reconciliation worksheet

- Legislative Appropriation Verification worksheet

Distribution begins in August and ends when the GR reconciliation is certified as reconciled and complete. Agencies may request a refreshed workbook on an as needed basis from their assigned financial reporting analyst.

For more information, see the AFR website’s Frequently Asked Questions, under the GR Reconciliation section.

USAS Profile Rollover

The automated rollover program creates new FY26 and AY26 profiles, unless one of the following conditions exists before end of day Friday, June 20, 2025:

- FY26 and AY26 profiles already exist with the same profile control key.

- FY25 and AY25 profiles are inactive.

- FY25 and AY25 profiles have an effective end date of (or prior to) Aug. 31, 2025.

To prevent the FY25 and AY25 profiles from rolling forward, an agency can choose to change the EFFECTIVE END DATE to 08/31/2025 on or before Friday, June 20, 2025.

As of Saturday, June 21, 2025, the agency must change the effective date back for the FY25 and AY25 profiles to be available for use in the 2025 fiscal and appropriation year.

For more information, see USAS Profile Review and Cleanup Procedures (FPP A.031).

Reporting Requirements Website

Will the AFR reporting requirements be updated to reflect the changes to the reconciliation process?

The reporting requirement website is updated during the summer continuously. New information is already available on several topics. The goal is to have all updates and edits completed by end of July.

GASB Statement No. 101, Compensable Leave

Yes. The Financial Reporting section reviewed the guidance regarding which flow assumption to choose:

- First-In First-Out (FIFO)

–or– - Last-In First-Out (LIFO)

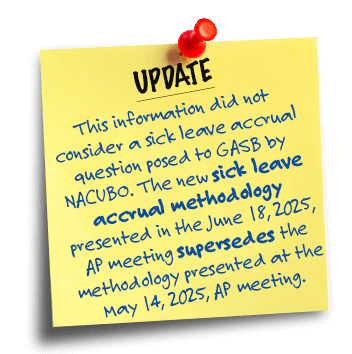

Use the LIFO flows assumption in evaluating whether a liability is accrued for sick leave. Under LIFO, the employee is only using the current year’s hours and never touches the accumulated balance from years past. If this happens year over year at the agency level, the sick leave balances continue to increase; therefore, it is more likely than not that accumulated hours would are not used. In this case, no sick leave liability is recognized.

The other compensable leave types continue to accrue as reported in prior fiscal years. The sick leave accrual is a new addition, effective as of fiscal 2025.

Yes. New reports will be available from CAPPS HR/Payroll to show the sick leave. It is yet to be determined if there will be one report for all leave types or two separate reports.

No. Medicare and Social Security taxes can be disregarded.