CAPPS Family Leave Pool Tax Instructions

Use the following time and labor time reporting codes (TRCs) to track leave pool hours, effective as of Sept. 1, 2021:

- FLVPA – Family Leave Pool Awarded

- FLVSD – Family Leave Pool Sick Donated

- FLVAD – Family Leave Pool Annual Leave Donated

- FLVSX – Family Leave Pool Sick Reclaimed

- FLVAX – Family Leave Pool Annual Leave Reclaimed

- FLVPR – Family Leave Pool Returned

- FLVPT – Family Leave Pool Taken

- FLVPO – Family Leave Pool Transfer Out

- FLVPI – Family Leave Pool Transfer In

The state employee family leave pool established by the 87th Legislature may or may not qualify as an employer-sponsored leave sharing plan for medical emergencies for Internal Revenue Service (IRS) purposes. Each agency should carefully review the statutory provisions as well as the IRS guidelines to determine the appropriate tax treatment of leave donated to and taken from the agency’s family leave pool. See Tax Implications of the Family Leave Pool (FPP A.049) for more information.

When awarded family leave pool leave is taken and paid, CAPPS will automatically accumulate taxable wages and withhold applicable taxes for the recipient, but it will not do so for the donor. If an agency determines that its family leave pool does not qualify under the medical emergencies leave sharing program exception, agency staff can make the adjustments manually by following instructions in the following sections.

Increasing Taxable Wages and Taxing the Donor

If an agency determines that the leave donor is responsible for the tax liability and taxes associated with the donated leave, it should complete the following steps:

- Enter FLVAD or FLVSD TRCs on the donor’s timesheet.

- Calculate non-cash earnings taxable gross.

- Hours donated multiplied by the hourly rate reflected in job data.

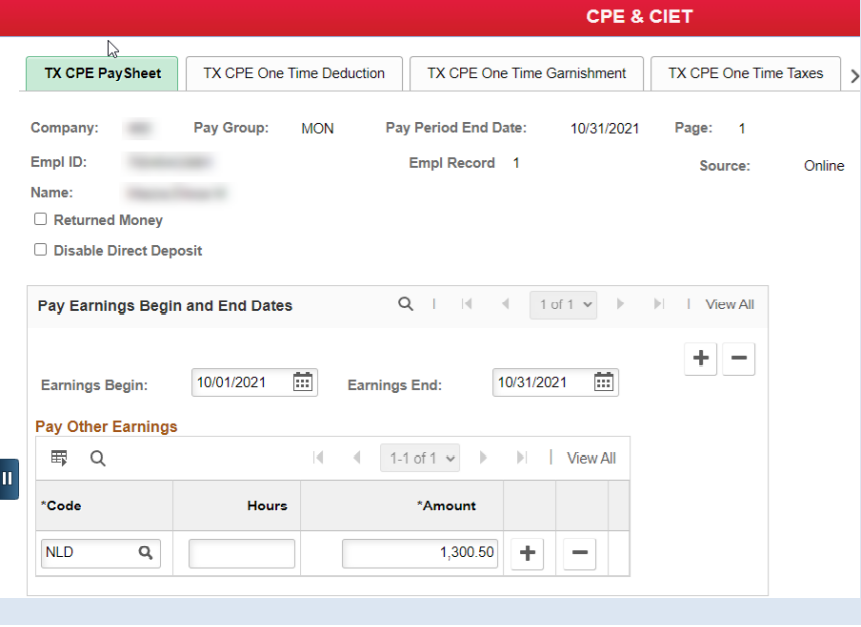

- Navigate to Navigator, Payroll for North America, Payroll Processing USA, TX CPE Main.

- Enter the non-cash earnings (non-cash leave donated – NLD) as a positive, taxable gross amount per the example below.

- 40 hours X 32.5125 = 1300.50

- Navigate to Navigator, Payroll for North America, Payroll Processing USA, TX CPE Main Load.

- Run the CPE main load process to load this data to the payline.

- Ensure there is enough positive pay (BSY or Other Additional Pays) available to process this NLD amount for the taxes to be deducted on the donor’s paycheck.

Note: If the donor reclaims the hours donated using a TRC of FLVSX or FLVAX, the agency is responsible for refunding the taxes by using a negative amount entry on the CPE main page using earnings code NLD to offset this transaction.

Reducing Taxable Wages and Taxes of Recipient

If an agency determines that the leave recipient should not accrue taxable wages or be taxed on leave taken from the family leave pool, it should complete the following steps:

- FLVPT TRCs are entered on the recipient’s timesheet.

- Calculate non-cash earnings taxable gross.

- Hours received multiplied by the hourly rate reflected in job data.

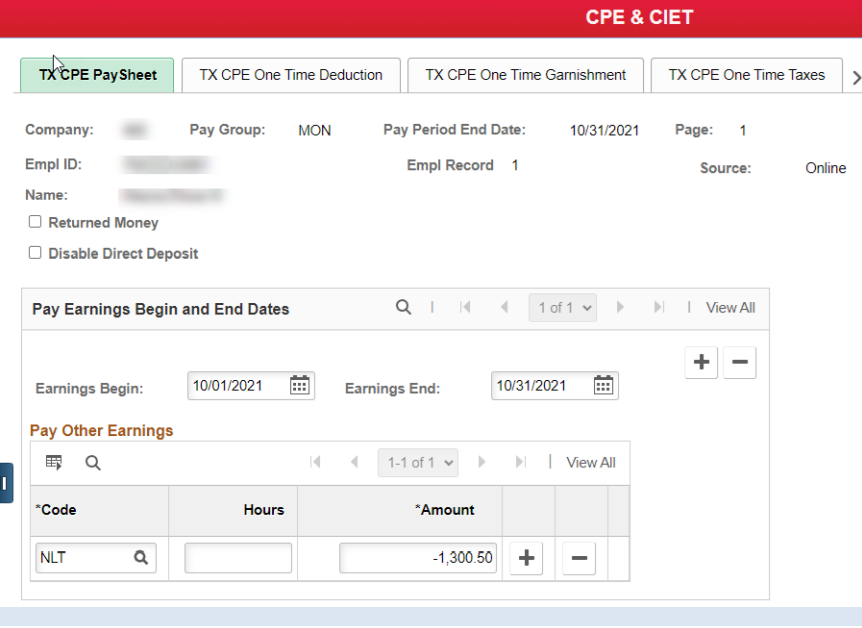

- Navigate to Navigator, Payroll for North America, Payroll Processing USA, TX CPE Main.

- Enter the non-cash earnings (non-cash leave taken – NLT) as a negative, taxable gross amount per the example below.

- 40 hours X 32.5125 = -1300.50

- Navigate to Navigator, Payroll for North America, Payroll Processing USA, TX CPE Main Load.

- Run the CPE main load process to load this data to the payline.