Reporting Requirements for Annual Financial Reports of State Agencies and Universities

Notes & Samples

NOTE 3 – Deposits, Investments and Repurchase Agreements

Instructions for the DINSS Web Application

General Description

Use the Deposit and Investment Note Submission System (DINSS) to electronically submit certain GASB disclosures and ensures uniformity of these disclosures for the ACFR. DINSS automatically extracts USAS general ledger account balances for deposits and investments. Agencies are able to save work-in-progress in DINSS at any time and later recall a record for edit or delete.

Reports are available in HTML and PDF format or may be downloaded into an Excel file. DINSS produces a statewide database and statewide reports for the ACFR disclosures used by the Financial Reporting section.

Component higher education agencies must not use DINSS but are still required to submit Note 3.

The following agencies must use DINSS in addition to submitting Note 3:

- State agencies

- Higher education systems

- Independent higher education agencies

Or click on the headings below to open a topic individually.

Disclosures That Must be Entered and Certified in DINSS and Submitted in Note 3 [+]

The following are entered in DINSS and disclosed in Note 3:

- Cash in bank carry amount

- Cash in bank balance

- Deposit custodial credit risk

- Deposit foreign currency risk

- Investment fair value

- Investment custodial credit risk

- Investment foreign currency risk

- Investment credit risk S&P

- Investment securities lending collateral pool fair value

Disclosures Only in Note 3 (Not Entered in DINSS) [+]

The following are disclosed in Note 3 because they are not submitted through DINSS:

- Concentration of credit risk

- Risk by investment type or class

- Securities lending

- Derivative disclosures

- Interest rate risk

Attention: Interest rate risk disclosure is only necessary for agencies required to prepare their AFR in accordance with GAAP. If an agency uses a Note 3 format in its published AFR other than the required Note 3 format, the agency can submit a supplement to the AFR with the interest rate risk disclosure in compliance with the required format shown in the Note 3 Sample.

In addition, the following agencies must disclose interest rate risk:

- Comptroller – Treasury Fiscal (Agency 311)

- Teacher Retirement System of Texas (Agency 323)

- Employees Retirement System of Texas (Agency 327)

- Texas Permanent School Fund Corporation (Agency 706)

- Texas A&M University System (Agency 798)

- University of Texas System (Agency 799)

Establish Security Access[+]

Ensure proper security access exists as early in the process as possible. Contact your agency’s security coordinator to request DINSS web application access for each agency number you are reporting.

Note: When requesting access from your security coordinator, ensure that you communicate the four-character Security Coordinator’s USAS Reference Code specific to this web application.

General Information about DINSS [+]

System Records

Individual records are saved to DINSS based on the unique combination of agency and fund type.

Agency Number

You may access a different agency number if you have established security for that agency. Click Select New Agency and the system returns to the Agency Selection screen.

USAS General Ledger Account Balances

USAS general ledger (GL) account balances are those balances from the previous USAS cycle. To change a USAS GL account balance on a record, exit DINSS and enter a USAS transaction. USAS must cycle in order for DINSS to update with the new USAS balance.

Screen Formats

Agency input boxes are the only fields available for entry. The other fields display information pulled from USAS GL account balances and is not editable in DINSS.

Screen Navigation

Press Tab to move between input boxes and calculate amounts without saving the record. Press Enter to save the record with the data entered up to that point.

Save Feature

Click Save and the status box displays the message Saving data. Once a record is saved, click Edit/Delete on the Note Disclosures navigation bar to make any changes to the existing record.

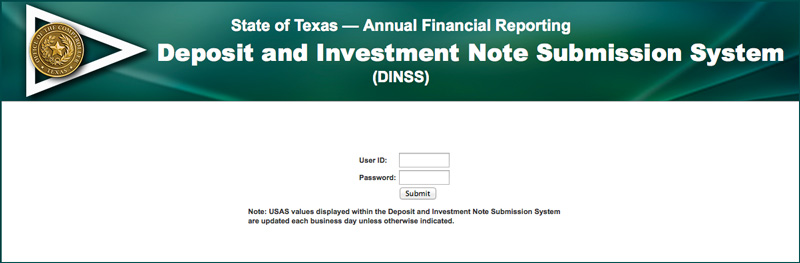

Log Into the DINSS Web Application [+]

Once proper security authorization is established, you can access the DINSS web application.

- Enter your

USER ID.Your User ID is the same as your ACID used to access the Comptroller’s mainframe and USAS.

- Enter your

PASSWORD.This is your USAS password.

- Click Submit to enter the DINSS web application.

If your DINSS web application security access is denied and an error message displays, contact your agency’s security coordinator.

DINSS loads investment data and a status bar appears below the login information indicating that the system is processing. After processing is complete, DINSS returns to the Home screen.

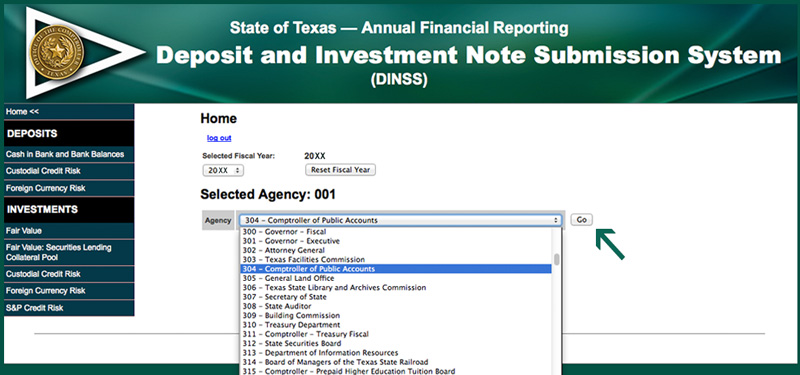

Selecting an Agency and Choosing Note Disclosures [+]

Your security allows you to access only those agencies for which you have security. A drop-down menu provides a list of all those agencies.

- Select an agency from the drop-down menu.

- Click Go.

The screen automatically refreshes and displays the agency selected. - Click an applicable disclosure in left navigation menu to begin entering disclosure information. The menu displays various deposit and investments note disclosures to be submitted through DINSS.

- Click either the Add, Edit/Delete or Reports action tab. This screen automatically defaults to Add.

General Information Applicable to All Disclosure Screens[+]

Agency input amounts in dollars and cents

Agency input amounts are in dollars and cents and reconcile to USAS GL account balances for the screens listed below. Differences between agency input amounts and USAS balances must equal zero before the agency can certify the following disclosure screens:

- Deposits – Cash in Bank and Bank Balances

- Investments – Fair Value

- Investments – Fair Value: Securities Lending Collateral Pool

The following screens do not reconcile to USAS:

- Deposits – Custodial Credit Risk

- Deposits – Foreign Currency Risk

- Investments – Custodial Credit Risk

- Investments – Foreign Currency Risk

- Investments – S&P Credit Risk

- Investments – Net Asset Value

Reports [+]

Viewing reports is an option available on all disclosure screens. To view a report for any agency for which you have established security:

- Select the agency from the drop-down menu.

- Select the desired report format and click Generate Report. Reports are available as:

- HTML format

- PDF file

- Excel file

Certification [+]

To certify, agencies must report certain GASB disclosures and fully reconcile all general ledger account balances for deposits and investments transactions entered in USAS.

On the Edit/Delete action tab, DINSS displays a red asterisk next to the fund type for any unreconciled records. Reconcile all necessary disclosures before certifying.

Click Certify to confirm the agency has completed all disclosures. Once certified, only the Report action tab is available. However, Certification is not allowed until all disclosure screens meet the following requirements:

- For the disclosure screens (a) Deposits — Cash in Bank and Bank Balances, (b) Investments — Fair Value, and (c) Investments — Fair Value: Securities Lending Collateral Pool:

- Agency input amounts are reconciled to USAS GL account balances in dollars and cents.

- Differences between agency input amounts and USAS balances must equal zero.

- The agency must not have records with a red asterisk on the Edit/Delete action tab.

- Agency input amounts for the Investments — Net Asset Value disclosure screen are reconciled to the total of the NAV input column in Investments — Fair Value. Differences between agency input amounts and USAS balances must equal zero. The agency must not have records with a red asterisk on the Edit/Delete action tab.

- Agency input amounts for the Investments — Credit Risk S&P disclosure screen are reconciled to USAS GL account balances. The amount from this disclosure screen is also verified against the total on the Investments — Fair Value disclosure screen. Differences between agency input amounts and USAS balances must be no greater than plus or minus .01 before the agency can certify. The agency may certify if there are records with a red asterisk on the Edit/Delete action tab.

- Agency input amounts on the Investments — Foreign Currency Risk disclosure screen are reconciled to agency input amounts saved on the Investments — Fair Value disclosure screen. Differences between agency input amounts and amounts pulled from the related disclosure screen must be no greater than plus or minus .01 before the agency can certify. The agency may certify if there are records with a red asterisk on the Edit/Delete action tab.

- Agency input amounts do not reconcile to USAS balances nor to a different disclosure screen for the screens listed below. There are no differences to verify before the agency can certify the following disclosure screens:

- Deposits – Custodial Credit Risk

- Deposits – Foreign Currency Risk

- Investments – Custodial Credit Risk

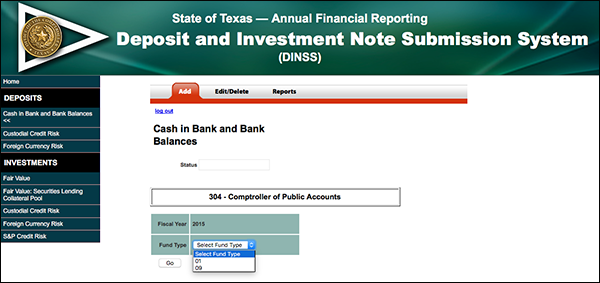

Deposits – Cash in Bank and Bank Balances Disclosure Screen [+]

| Disclosure | Deposit Carry Amount Deposit Bank Balance |

|---|---|

| Reconcile to USAS? | Yes Cash in Bank USAS GL Account Classes Differences between agency input amounts and USAS balances must equal zero before the agency can certify |

| Amounts | All amounts in dollars and cents |

The agency input cash in bank carry amount must be adjusted in order to reconcile to the total cash in bank USAS GL account balances. These adjustments subtract amounts included in the agency input amounts as cash in bank carry amount but that are recorded to investment GL accounts in USAS. Adjustments include:

- Non-negotiable CDs placed directly with financial institutions and generally subject to penalty for early redemption

- Uninvested securities lending cash collateral

- Securities lending collateral in the form of a nonnegotiable CD

| Deposits (dollars and cents) | |

|---|---|

| Field Title | Action |

| Cash in Bank Carry Amount | Enter/edit amount as a positive (A) |

| Less: Nonnegotiable CDs Included in Carry Amount | Enter/edit amount as a positive (B) |

| Less: Uninvested Cash Collateral Included in Carry Amount | Enter/edit amount as a positive (C) |

| Less: CD Collateral Included in Carry Amount | Enter/edit amount as a positive (D) |

| Bank Balance | Enter/edit amount as a positive |

| Total Cash in Bank per AFR | Calculated amount (E) = A – B – C – D |

| GL Acct Class 002 CA Cash in Bank | Extracted from USAS (F) |

| GL Acct Class 011 CA Restricted Cash in Bank | Extracted from USAS (G) |

| GL Acct Class 120 NC Restricted Cash in Bank | Extracted from USAS (H) |

| Difference Between CIB and USAS GL balances (must be zero to certify) |

Calculated amount = E – F – G – H |

Determine if you need to add, edit or delete a record [+]

- Click the Edit/Delete action tab. All saved records are displayed.

- If the agency and fund type combination is not listed, you need to add a record. Click the Add action tab. The system takes you to the Note Disclosures screen.

–OR–

If the agency and fund type combination is listed, you previously saved this record to the system. Only an edit or a delete to this record is allowed. Click Edit or Del for this record.

Add a record [+]

- Click the Add action tab.

- Select a fund type from the drop-down menu. The status box displays the message Processing. Please wait. indicating that DINSS is extracting the USAS GL account balances from the prior USAS cycle.

- To enter the agency input amounts:

- Press Tab until the cursor moves to the agency input box where you want to enter amounts.

- Enter the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation.

- Click Save. The status box displays the message Saving data and the system takes you to the Edit/Delete action tab.

- If the USAS GL account balances are correct, proceed to a different disclosure screen or click Log Out to exit DINSS.

–OR–

If the USAS GL account balances are incorrect, click Log Out to exit DINSS. Enter a USAS transaction to change the incorrect USAS GL account balance. Wait for a USAS cycle to process in order for DINSS to update with the new USAS balance.

Edit a record [+]

- Click Edit for that record to access the edit screen. DINSS displays the agency input amounts as currently saved and the USAS GL account balances from the prior USAS cycle, if applicable.

- Press Tab until the cursor moves to the agency input box you want to edit.

- Edit the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation. You may edit and recalculate as many times as necessary before proceeding to the next step.

- Click Save. The status box displays the message Saving, Please wait. The system returns to the edit screen.

- Select another record to edit, proceed to a different disclosure screen or click Log Out to exit DINSS.

Delete a record [+]

- Click Del for that record to access the delete screen. DINSS displays the agency input amounts as currently saved and USAS GL account balances from the prior USAS cycle, if applicable.

- Click Confirm Delete. The status box displays the message Deleting, Please wait. The system returns to the delete screen. You may select another record to delete, proceed to a different disclosure screen or click Log Out to exit DINSS.

Deposits – Custodial Credit Risk Disclosure Screen [+]

| Disclosure | Deposit Custodial Credit Risk |

|---|---|

| Reconcile to USAS? | No |

| Amounts | All amounts in dollars and cents |

| Deposits Custodial Credit Risk (in thousands) | |

|---|---|

| Field Title | Action |

| Bank Balance that is Uninsured and Uncollateralized | Enter/edit amount |

| Bank Balance that is Uninsured and Collateralized with Securities Held by the Pledging Financial Institution | Enter/edit amount |

| Bank Balance that is Uninsured and Collateralized with Securities Held by the Pledging Financial Institution’s Trust Department or Agent but NOT in the agency’s name | Enter/edit amount |

Determine if you need to add, edit or delete a record [+]

- Click the Edit/Delete action tab. All saved records are displayed.

- If the agency and fund type combination is not listed, you need to add a record. Click the Add action tab. The system takes you to the Note Disclosures screen.

–OR–

If the agency and fund type combination is listed, you previously saved this record to the system. Only an edit or a delete to this record is allowed. Click Edit or Del for this record.

Add a record [+]

- Click the Add action tab.

- Select a fund type from the drop-down menu. The status box displays the message Processing. Please wait. indicating that DINSS is extracting the USAS GL account balances from the prior USAS cycle.

- To enter the agency input amounts:

- Press Tab until the cursor moves to the agency input box where you want to enter amounts.

- Enter the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation.

- Click Save. The status box displays the message Saving data and the system takes you to the Edit/Delete action tab.

Edit a record [+]

- Click Edit for that record to access the edit screen. DINSS displays the agency input amounts as currently saved and the USAS GL account balances from the prior USAS cycle, if applicable.

- Press Tab until the cursor moves to the agency input box you want to edit.

- Edit the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation. You may edit and recalculate as many times as necessary before proceeding to the next step.

- Click Save. The status box displays the message Saving, Please wait. The system returns to the edit screen.

- Select another record to edit, proceed to a different disclosure screen or click Log Out to exit DINSS.

Delete a record [+]

- Click Del for that record to access the delete screen. DINSS displays the agency input amounts as currently saved and USAS GL account balances from the prior USAS cycle, if applicable.

- Click Confirm Delete. The status box displays the message Deleting, Please wait. The system returns to the delete screen. You may select another record to delete, proceed to a different disclosure screen or click Log Out to exit DINSS.

Deposits – Foreign Currency Risk Disclosure Screen [+]

| Disclosure | Deposit Foreign Currency Risk |

|---|---|

| Reconcile to USAS? | No |

| Amounts | All amounts in dollars and cents |

| Deposits Foreign Currency Risk (in thousands) | |

|---|---|

| Field Title | Action |

| Various foreign currency fields | Enter/edit amounts |

Determine if you need to add, edit or delete a record [+]

- Click the Edit/Delete action tab. All saved records are displayed.

- If the agency and fund type combination is not listed, you need to add a record. Click the Add action tab. The system takes you to the Note Disclosures screen.

–OR–

If the agency and fund type combination is listed, you previously saved this record to the system. Only an edit or a delete to this record is allowed. Click Edit or Del for this record.

Add a record [+]

- Click the Add action tab.

- Select a fund type from the drop-down menu. The status box displays the message Processing. Please wait. indicating that DINSS is extracting the USAS GL account balances from the prior USAS cycle.

- To enter the agency input amounts:

- Press Tab until the cursor moves to the agency input box where you want to enter amounts.

- Enter the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation.

- Click Save. The status box displays the message Saving data and the system takes you to the Edit/Delete action tab.

Edit a record [+]

- Click Edit for that record to access the edit screen. DINSS displays the agency input amounts as currently saved and the USAS GL account balances from the prior USAS cycle, if applicable.

- Press Tab until the cursor moves to the agency input box you want to edit.

- Edit the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation. You may edit and recalculate as many times as necessary before proceeding to the next step.

- Click Save. The status box displays the message Saving, Please wait. The system returns to the edit screen.

- Select another record to edit, proceed to a different disclosure screen or click Log Out to exit DINSS.

Delete a record [+]

- Click Del for that record to access the delete screen. DINSS displays the agency input amounts as currently saved and USAS GL account balances from the prior USAS cycle, if applicable.

- Click Confirm Delete. The status box displays the message Deleting, Please wait. The system returns to the delete screen. You may select another record to delete, proceed to a different disclosure screen or click Log Out to exit DINSS.

Investments – Mapping of Investment Explanations to DINSS [+]

| Dinns # | Investment Type | Investment Type Examples (not all inclusive) | Item # |

|---|---|---|---|

| A | U.S. Treasury Securities | U.S. Treasury Bills, Notes or Bonds — only available as short-term investments. Risk level: Low |

46 |

| B | U.S. Treasury Strips | U.S. Treasury Strips —

do not offer periodic interest payments (all payments are received upon maturity) Risk level: Low |

46 |

| C | U.S. Treasury TIPS | U.S. Treasury TIPS —

protect against inflation and are long-term investments (mature in 5, 10 or 30 years) Risk level: Low |

46 |

| D | U.S. Government Agency Obligations | Asset and mortgage backed securities issued by government sponsored enterprises (such as Fannie Mae, Freddie Mac or Ginnie Mae) Risk level: Moderate |

6, 25, 45 |

| E | Corporate Obligations | Domestic corporate obligations Risk level: Low to High — depending on the corporation’s credit rating |

2, 15, 21, 27, 29, 31 |

| F | Corporate Asset and Mortgage Backed Securities | Collateralized mortgage obligation, mortgage backed securities or commercial mortgage backed securities. Risk level: Low to High — depending on the payments affected by mortgage rates |

2, 8, 26 |

| G | Equity | Domestic equity Risk level: Low to High — depending on diversification, generally less risky than investing directly in stocks |

14, 17, 33, 34 |

| H | International Obligations | Foreign obligations issued by governments, corporations or ADRs. Risk level: Low to High — depending on the foreign entity |

15, 43 |

| I | International Equity | Foreign equity (including foreign securities that are U.S. dollar denominated) Risk level: Low to High — depending on diversification |

17, 33, 34 |

| J | Repurchase Agreements | Repurchase agreements Risk level: Low |

6, 38 |

| K | Fixed Income Money Market and Bond Mutual Fund | Pooled investments of fixed income securities Risk level: Low |

18, 42 |

| L | Mutual Funds | Mutual funds registered with the Securities and Exchange Commission, and the bank loans Risk level: Low to moderate — depending on diversification |

3, 16, 18, 24, 28 |

| M | Other Commingled Funds | Other commingled funds Risk level: Low to moderate |

11, 35, 44 |

| N | International Other Commingled Funds | Foreign securities of other commingled funds Risk level: Low to moderate |

11 |

| O | Commercial Paper | Commercial paper Risk level: Moderate due to rollover risk |

10, 30 |

| P | Invested Collateral | Reinvested cash collateral related to securities lending and derivative activity Risk level: Low to moderate — depending on type of reinvestment (usually money market or repurchase agreements) |

32 |

| Q | Securities Lending Collateral Investment Pool | Securities lending collateral investment pool Risk level: Low to moderate |

39 |

| R | Real Estate | Real estate, REITS and mineral rights. Risk level: Moderate to high |

36, 37 |

| S | Derivatives | Forwards, futures, options and swaps. Risk level: Moderate to high |

12, 20, 32 |

| T | Externally Managed Investments (Alternative Investments) | Private equity, venture capital and hedge fund. Risk level: High |

20, 40 |

| U | Miscellaneous | Political subdivisions and other investments Risk level: Low to high |

1, 5, 7, 9, 12, 13, 19, 22 |

Guidance for Investment and Deposit Types (not all inclusive)

| Item # | Investment | Explanation | DINSS # |

|---|---|---|---|

| 1 | Annuity | A type of contract sold by insurance companies guaranteeing fixed or variable future payments. | U |

| 2 | Asset Backed Securities (ABS) | Securities backed by pools of assets such as credit card receivables, home equity loans, and auto loans, but typically excluding mortgages. | E, F |

| 3 | Balanced Mutual Funds | Mutual Funds that expect to invest in a mix of equity and debt investments. (Categorize in the "Publicly Traded Equity & Similar" category if the fund's target allocation is expected to be > 50% equities. Otherwise, categorize in the "Publicly Traded Debt & Similar" category.) (See Mutual Funds.) | L |

| 4 | Bank Deposits | Amounts reported in this category should include balances held in a financial institution such as a bank, savings bank, or credit union as "demand deposits" (which the customer can withdraw at any time without penalty) or "time deposits" (which might be subject to restrictions on immediate withdrawal). However, do not include certificates of deposit. Although non-negotiable certificates of deposit are generally considered time deposits, these balances should be separately disclosed on the annual investment report. (See Certificates of Deposit.) | n/a |

| 5 | Bankers’ Acceptances | A time draft drawn on a bank by a bank's customer, ordering the bank to pay an amount at a future date, generally within a short time period. When accepted by the bank, it can be traded in secondary markets, usually as a money market instrument. | U |

| 6 | Cash Held at State Treasury | All deposit balances held by the state Comptroller in the state treasury. Institutions do not include funds invested in TexPool or TexPool Prime. Amounts managed by the Texas State Treasury Safekeeping Trust Company are reported in the appropriate investment categories and any uninvested cash held by the Trust Company are reported as bank deposits. | D, J |

| 7 | Certificate of Deposit (CD) | Time deposits with a financial institution that may not be withdrawn prior to maturity without a penalty. "Negotiable CDs" are issued in large dollar amounts and are traded in secondary markets. Although some entities might report nonnegotiable CDs in their financial statements under the "Investments" category, they are considered deposits, whereas negotiable CDs represent investment securities. CDs are insured by the Federal Deposit Insurance Company. (Categorize nonnegotiable CDs separately from negotiable CDs on the annual investment report.) | U |

| 8 | Collateralized Mortgage Obligations (CMOs) – Agency or Private Label | CMOs consist of pools of mortgage pass-through securities or mortgage loans in which the cash flows of principal and interest payments are directed in a prescribed manner to different underlying classes of the CMOs. The different classes are referred to as "tranches," with each tranche structured to have different expected risk, return, and maturity characteristics. "Agency" CMOs are those that are guaranteed, or issued and guaranteed, by U.S. government agencies. "Private Label" CMOs are issued by, and are the sole obligation of, the private issuers, which might be financial institutions, subsidiaries of investment banks, or home builders. Certain tranches are generally prohibited by the PFIA, including "Interest Only Strips (IOs)," "Principal Only Strips (POs)," and "Inverse Floaters." The PFIA also does not authorize most investing entities to acquire CMOs that have a final stated maturity exceeding 10 years. | F |

| 9 | Collectibles | Rare items collected by investors, such as art, stamps, coins, antiques and memorabilia. | U |

| 10 | Commercial Paper – A1/P1 (or equivalent) | Commercial paper is a type of short-term, unsecured obligation issued by banks, corporations, or other borrowers, usually issued at a discount and with maturities of 270 days or less. A1 and P1 denote the highest short-term rating categories used by Standard & Poors and Moody's, respectively. (Lower rated commercial paper should be listed under "Other Commercial Paper — Lower Rated.") | O |

| 11 | Commingled Fund | An external manager pools and invests the funds of several institutional investors. Securities are owned by the overall fund, and each investor owns a pro rata share of the fund. The SEC does not oversee commingled funds. (Classification on the annual investment report should be based on the underlying assets in which the fund primarily invests, e.g., publicly traded equities, publicly traded debt, or "other" investments.) | M, N |

| 12 | Commodities | Includes investments in bulk goods such as grains, metals, foods, energy products such as crude oil, heating oil, gasoline, and natural gas. Commodities are often traded using futures contract; however, investing can also involve spot market trades or taking physical possession of the commodities. | S, U |

| 13 | Commonfund | Also known as "The Common Fund for Nonprofit Organizations," this is a private, nonprofit organization that is exempt from taxation under Section 501[f]), Internal Revenue Code of 1986 (26 U.S.C. Section 501(f)). Commonfund offers participating clients the ability to invest in a wide range of commingled investment funds, including fixed income, equity, and alternative assets. | U |

| 14 | Common Stock (publicly traded) | Also referred to as equities (or equity securities,) common stock represents units of ownership in a publicly held corporation. Shareholders typically have rights to vote and to receive dividends. Claims of common stockholders are subordinate to claims of creditors, bond holders and preferred stockholders. | G |

| 15 | Corporate Obligations (U.S. or foreign corporations | Debt securities issued by U.S. or foreign corporations. Excludes debt issued by governmental entities (see Sovereign Debt). (Group by credit rating category or [if applicable] as “not rated.”) | E, H |

| 16 | Equity/Stock Mutual Funds | Mutual funds that invest primarily in stocks, although at times they might hold some fixed-income and money market securities. (See also Balanced Funds description.) | L |

| 17 | Equity Securities | Stock as opposed to bonds. The term is often used to refer to "common stock" (see Common Stock); however "preferred stock" is also considered an equity security (see Preferred Stock). | G, I |

| 18 | Fixed Income/Bond Mutual Funds | Mutual Funds that, by policy, invest in the fixed-income sector. (See Mutual Funds.) | K, L |

| 19 | GICs (Guaranteed Investment Contracts) | GICs represent contracts issued by insurance companies that promise to pay a specified rate of interest on the invested capital over the life of the contract. GICs are sometimes referred to as "guaranteed insurance contracts." | U |

| 20 | Hedge Funds | Hedge funds may be broadly defined as pooled funds that are not registered with the SEC; are typically available only to institutional investors or individuals with a high net worth; and use advanced trading strategies such as leverage, derivatives, short selling, and arbitrage. | S, T |

| 21 | Highly Rated Corporate Obligations | Based on the description in the PFIA for "Authorized Investments: Institutions of Higher Education," this category is limited to corporate debt obligations rated by a nationally recognized investment rating agency in one of its two highest long-term rating categories, without regard to gradations (for example + or -) within those categories. The two highest rating categories for Standard and Poor's and Fitch Ratings are AAA and AA, while the two highest categories for Moody's are Aaa and Aa. | E |

| 22 | High Yield Bonds | Corporate obligations that are considered below "investment grade" and are also referred to as "junk bonds" or "speculative grade." Such corporate securities are rated BB or lower by Standard and Poor's or Fitch Ratings and Ba or lower by Moody's. | U |

| 23 | N/A | N/A | N/A |

| 24 | Money Market Mutual Fund (or Money Market Fund) | An open-end mutual fund (registered with the SEC) that must comply with the SEC's "Rule 2a-7," which imposes certain restrictions, such as a requirement that the fund's board must attempt to maintain a stable net asset value (NAV) per share or stable price per share, limits on the maximum maturity of any individual security in the fund's portfolio and on the maximum weighted average portfolio maturity and weighted average portfolio life. Money market funds typically attempt to maintain an NAV or a price of $1.00 per share. (Institutions report the "market value" of their money market fund investments based on the fund's share price.) | L |

| 25 | Mortgage Pass-Throughs – Agency | Mortgage pass-throughs are securities created by pooling mortgages in which investors receive a pro-rata share of payments of principal and interest on the pool of mortgages. Agency mortgage pass-throughs are guaranteed by a U.S. government agency or government sponsored enterprise (GSE). | D |

| 26 | Mortgage Pass-Throughs – Private Label | Private label mortgage pass-throughs are issued by institutions such as subsidiaries of investment banks, financial institutions, and home builders. They are the obligation of the issuers and are not guaranteed by the U.S. government or any government sponsored enterprise. | F |

| 27 | Municipal Obligations | Debt, typically bonds, issued by states, cities, counties or other government entities. Income on some municipal bonds is exempt from both federal and state income taxes, while, for other municipal bonds, the income is not exempt from federal taxation. | E |

| 28 | Mutual Funds | Similar to commingled funds, the funds of multiple investors are pooled by the external manager. The investors own shares of the fund but do not own the individual securities. The public (as well as institutional investors) can invest in mutual funds. In contrast with commingled funds, mutual funds are regulated by the SEC. (See Money Market Funds, a subset of mutual funds that is categorized separately.) | L |

| 29 | Not Rated (NR) Corporate Obligations | Issues that have not been rated by a major rating agency. Standard and Poor's uses NR to designate issues for which no rating was requested, there was insufficient information on which to assign a rating or (by policy) it does not rate that particular obligation. | E |

| 30 | Other Commercial Paper – lower rated | Commercial paper rated below the highest short-term rating categories used by major rating agencies (in other words, below A-1, P-1 or equivalent ratings). | O |

| 31 | Other Investment Grade Corporate Obligations | Corporate debt obligations that are not categorized as "Highly Rated Corporate Obligations" but, nevertheless, receive an "investment grade" rating from a nationally recognized investment rating agency. Ratings of A or BBB by Standard and Poor's or Fitch Ratings and A or Baa by Moody's are considered "investment grade." | E |

| 32 | Other Real Asset Investments | Real assets typically exist in physical form and are generally considered to include "hard assets" that are used to produce goods or services — in contrast to "financial assets" (such as stocks and bonds) that represent a claim on the income provided by real assets. Examples of real assets include real estate, timber, commodities (like oil and gas) and infrastructure. (Institutions categorize investments in real estate separately from their investments in "other real assets" if managed as distinct portfolios. See Real Estate.) | P, S |

| 33 | Preferred Stock | A class of capital stock in a corporation distinct from common stock. Preferred stock generally carries no voting rights, pays a specified dividend, and it has preference over common stock in the payment of dividends or in the event that corporate assets are liquidated. Although preferred stock has some features similar to bonds, it is classified as an "equity" investment. | G, I |

| 34 | Private Equity | Private equity funds are privately managed investment pools, typically organized as limited partnerships. They are managed by the fund's general partners who typically make long-term investments in private companies and who may take a controlling interest with the aim of increasing the value of these companies, often by helping to manage the companies. Private equity fund strategies include venture capital investments and leveraged buyouts, among others. (Institutions that make direct investments in private companies, often as "co-investments" alongside a private equity fund in which they invest, should also categorize such investments as "Private Equity.") | G, I |

| 35 | Public Funds Investment Pool Created to Function as a Money Market Mutual Fund & Other Investment Pools | The PFIA describes the criteria for allowable investments in "investment pools" — including those it describes as a "public funds investment pool created to function as a money market mutual fund." These types of pools are typically also referred to as "local government investment pools" or "LGIPs" and often function like money market mutual funds (see "TexPool" and "Money Market Funds"). These types of pools might be referred to as "2a7-like" pools but they are not required to register with the SEC. Other investment pools might not function like money market funds and therefore might permit a floating NAV, longer overall or individual investment maturity and higher potential investment risk and return. (Institutions will separately categorize investments in (1) TexPool, (2) Other Public Funds Investment Pools Functioning as Money Market Mutual Funds and (3) Other Investment Pools that do not operate as money market funds. | M |

| 36 | Real Estate | Real estate includes those held for investment directly or through investment vehicles (such as private investment funds that are limited partnerships that invest in real estate). Such investments are designed to produce high current income and/or capital gains through appreciation in the underlying real estate. (Real Estate does not include real estate that is not held for investment (such as campus buildings). | R |

| 37 | REITs (Real Estate Investment Trusts) | Real estate investment trusts (REITs) are companies that invest in real estate by investing directly in portfolios of various types of real estate properties and/or by making loans to building developers. Although they are generally publicly traded on major exchanges and available to all investors, some REITs are established as private investments, which can reduce the liquidity of such investments. (Private REITs are categorized on the annual investment report as Real Estate in "Other Investments.") | R |

| 38 | Repurchase Agreements (Repos) | Short-term investment agreements in which an investor buys securities (usually U.S. government securities) from a seller and the seller agrees to repurchase them at a later date for a slightly higher price that is negotiated between the parties. Such arrangements function as money market investments with either a fixed maturity date (often overnight) or an open term (in which they are callable at any time). | J |

| 39 | Securities Lending Collateral Reinvestments | Institutions that participate in securities lending programs often receive cash as collateral for their loaned investments. The cash is normally reinvested (typically by the entity’s lending agent) in a separate account for the lender or as part of a collateral investment pool that commingles the cash collateral received by multiple lenders. The cash collateral is typically invested in investments having relatively low credit risk and interest rate risk is reduced by maintaining a relatively short average portfolio maturity. (An institution involved with securities lending reports the value for its share of any reinvested cash collateral in the same amount on its annual investment report and on its financial statements.) | Q |

| 40 | Separately Managed Account | Securities in the external manager's portfolio are owned directly by the investing entity and are held by each investing entity's custodian bank. The investing entity can require the external manager to adhere to specific investment guidelines. | T |

| 41 | N/A | N/A | N/A |

| 42 | Short-Term Mutual Funds (other than Money Market funds) | Mutual funds that specialize in short-term debt instruments but do not meet the strict criteria required to be called "money market" mutual funds. (If not reported as fixed income mutual funds in the section for Debt and Similar Investments > 1 Year Maturity, institutions will report non-money market and short-term fixed income mutual funds in the section for Short-Term Investments and Deposits.) | K |

| 43 | Sovereign Debt (non-U.S.) | Debt securities issued or guaranteed by foreign governments. | H |

| 44 | TexPool (and TexPool Prime) | TexPool and TexPool Prime are local government investment pools administered by the Texas Treasury Safekeeping Trust Company at the Texas Comptroller of Public Accounts. Both funds are operated according to the rules governing money market mutual funds (the SEC’s "Rule 2a-7"), which require a policy to maintain a stable net asset value per share (both funds seek to maintain a $1.00 NAV per share) and impose limitations on maximum maturities of the overall portfolio and any individual security. Unlike true mutual funds, local government investment pools (whether or not organized to operate as money market mutual funds) are not required to register with the SEC. | M |

| 45 | U.S. Government Agency Securities | Also called "Agency Securities" or "Agencies," these represent debt securities (1) issued or guaranteed by U.S. federal government agencies or (2) issued by government sponsored enterprises (GSEs). Debt securities issued or guaranteed by U.S. federal government agencies (like U.S. Treasury Securities) are backed by the full faith and credit of the U.S. government. However, debt securities issued by GSEs are not backed by similar U.S. government guarantees and therefore are considered to carry more credit risk than securities issued or guaranteed by federal government agencies. | D |

| 46 | U.S. Government Securities | Also called "U.S. Treasury Securities" or "Treasuries," U.S. Government securities are negotiable debt obligations (such as Treasury Bills, Treasury Notes and Treasury Bonds) that are backed by the full faith and credit of the United States government. | A, B, C |

Investments – Fair Value Disclosure Screen [+]

| Disclosure | Investment fair value by Investment Type and Fair Value Hierarchy |

|---|---|

| Reconcile to USAS? | Yes

Investment Type USAS GL Account Classes Before the agency can certify:

|

| Amounts | All amounts in dollars and cents |

The agency input total investment fair value must be adjusted in order to reconcile to the total investment USAS GL account balances. These adjustments will add amounts that are not included in the agency input amounts for investment fair value but are recorded to USAS investment GL accounts. For example:

- Nonnegotiable CDs placed directly with financial institutions and generally subject to penalty for early redemption

- Uninvested securities lending cash collateral

- Securities lending collateral in the form of a nonnegotiable CD

| Investments Fair Value (dollars and cents) | |

|---|---|

| Field Title | Action |

| Various Investment types | Enter/edit amounts as a positive (A) |

| Plus: Nonnegotiable CDs not Included in Inv Fair Value | Extracted from the Deposits – Cash in Bank and Bank Balances disclosure screen as a positive (B) |

| Plus: Uninvested Cash Collateral not Included in Inv Fair Value | Extracted from the Disclosures Menu Deposit Tab as a positive (C) |

| Plus: CD Collateral not included in Inv Fair Value | Extracted from the Deposits – Cash in Bank and Bank Balances disclosure screen as a positive (D) |

| Total Inv Fair Value per AFR | Calculated amount (E) = A + B + C + D |

| GL Acct Class 005 Securities Lending Collateral | Extracted from USAS (F) |

| GL Acct Class 006 CA Cash Equivalent | Extracted from USAS (G) |

| GL Acct Class 008 CA Short Term Investments | Extracted from USAS (H) |

| GL Acct Class 014 CA Restricted Cash Equivalents | Extracted from USAS (I) |

| GL Acct Class 016 CA Restricted Short Term Investments | Extracted from USAS (J) |

| GL Acct Class 123 NC Restricted Cash Equivalent | Extracted from USAS (K) |

| GL Acct Class 128 NC Restricted Short Term Investments | Extracted from USAS (L) |

| GL Acct Class 130 NC Restricted Investments | Extracted from USAS (M) |

| GL Acct Class 147 NC Investments | Extracted from USAS (N) |

| Difference Between Inv Fair Value and USAS GL balances (must be zero to certify) | Calculated amount = E – F – G – H – I – J – K – L – M – N |

Determine if you need to add, edit or delete a record [+]

- Click the Edit/Delete action tab. All saved records are displayed.

- If the agency and fund type combination is not listed, you need to add a record. Click the Add action tab. The system takes you to the Note Disclosures screen.

–OR–

If the agency and fund type combination is listed, you previously saved this record to the system. Only an edit or a delete to this record is allowed. Click Edit or Del for this record.

Add a record [+]

- Click the Add action tab.

- Select a fund type from the drop-down menu. The status box displays the message Processing. Please wait. indicating that DINSS is extracting the USAS GL account balances from the prior USAS cycle.

- To enter the agency input amounts:

- Press Tab until the cursor moves to the agency input box where you want to enter amounts.

- Enter the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation.

- Click Save. The status box displays the message Saving data and the system takes you to the Edit/Delete action tab.

- If the USAS GL account balances are correct, proceed to a different disclosure screen or click Log Out to exit DINSS.

–OR–

If the USAS GL account balances are incorrect, click Log Out to exit DINSS. Enter a USAS transaction to change the incorrect USAS GL account balance. Wait for a USAS cycle to process in order for DINSS to update with the new USAS balance.

Edit a record [+]

- Click Edit for that record to access the edit screen. DINSS displays the agency input amounts as currently saved and the USAS GL account balances from the prior USAS cycle, if applicable.

- Press Tab until the cursor moves to the agency input box you want to edit.

- Edit the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation. You may edit and recalculate as many times as necessary before proceeding to the next step.

- Click Save. The status box displays the message Saving, Please wait. The system returns to the edit screen.

- Select another record to edit, proceed to a different disclosure screen or click Log Out to exit DINSS.

Delete a record [+]

- Click Del for that record to access the delete screen. DINSS displays the agency input amounts as currently saved and USAS GL account balances from the prior USAS cycle, if applicable.

- Click Confirm Delete. The status box displays the message Deleting, Please wait. The system returns to the delete screen. You may select another record to delete, proceed to a different disclosure screen or click Log Out to exit DINSS.

Investments – Fair Value: Securities Lending Collateral Pool Disclosure Screen [+]

| Disclosure | Securities Lending Collateral Pool Fair Value by Investment Type |

|---|---|

| Reconcile to USAS? | No |

| Amounts | All amounts in dollars and cents |

This disclosure is to be completed only by those agencies that operate their own securities lending collateral pools:

- Teacher Retirement System

- Employees Retirement System

- Texas Permanent School Fund Corporation

- University of Texas System (Permanent University Fund)

Provide the fair value for reinvested securities lending cash collateral by investment type and fair value hierarchy. The total of the investment type hierarchy levels must equal the input total of the investment type. The agency input total securities lending collateral pool fair value must be adjusted in order to reconcile to the total securities lending collateral USAS GL account balance. These adjustments will add amounts that are not included in the agency input amounts for securities lending collateral pool fair value but are recorded to investment GL accounts in USAS. For example:

- Uninvested securities lending cash collateral

- Securities lending collateral in the form of a nonnegotiable CD

| Securities Lending Collateral Pool Fair Value (dollars and cents) | |

|---|---|

| Field Title | Action |

| Various investment types | Enter/edit amounts as a positive (A) |

| Securities Lending Collateral Pool from Inv Fair Value | Extracted from the Invested Collateral field of the Investments — Fair Value disclosure screen as a positive (B) |

| Difference Between Securities Lending Collateral Pool Entered and Securities Lending Collateral Pool from Inv Fair Value | Calculated amount (C) = (A) – (B) |

Determine if you need to add, edit or delete a record [+]

- Click the Edit/Delete action tab. All saved records are displayed.

- If the agency and fund type combination is not listed, you need to add a record. Click the Add action tab. The system takes you to the Note Disclosures screen.

–OR–

If the agency and fund type combination is listed, you previously saved this record to the system. Only an edit or a delete to this record is allowed. Click Edit or Del for this record.

Add a record [+]

- Click the Add action tab.

- Select a fund type from the drop-down menu. The status box displays the message Processing. Please wait. indicating that DINSS is extracting the USAS GL account balances from the prior USAS cycle.

- To enter the agency input amounts:

- Press Tab until the cursor moves to the agency input box where you want to enter amounts.

- Enter the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation.

- Click Save. The status box displays the message Saving data and the system takes you to the Edit/Delete action tab.

Edit a record [+]

- Click Edit for that record to access the edit screen. DINSS displays the agency input amounts as currently saved and the USAS GL account balances from the prior USAS cycle, if applicable.

- Press Tab until the cursor moves to the agency input box you want to edit.

- Edit the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation. You may edit and recalculate as many times as necessary before proceeding to the next step.

- Click Save. The status box displays the message Saving, Please wait. The system returns to the edit screen.

- Select another record to edit, proceed to a different disclosure screen or click Log Out to exit DINSS.

Delete a record [+]

- Click Del for that record to access the delete screen. DINSS displays the agency input amounts as currently saved and USAS GL account balances from the prior USAS cycle, if applicable.

- Click Confirm Delete. The status box displays the message Deleting, Please wait. The system returns to the delete screen. You may select another record to delete, proceed to a different disclosure screen or click Log Out to exit DINSS.

Investments – Net Asset Value [+]

| Disclosure | Investments at NAV by strategy, disclose:

|

|---|---|

| Reconcile to USAS? | No Before the agency can certify, differences between the agency strategy type input total and the total of investment reported at NAV must equal zero. |

| Amounts | All amounts in dollars and cents |

| Investments Net Asset Value (dollars and cents) | |

|---|---|

| Field Title | Action |

| Investments Net Asset Value (dollars and cents) | Enter/edit amounts as a positive (A) |

| Total Reported at NAV | Extracted from Investments Fair Value (B) |

| Difference Between NAV Strategies and Fair Value NAV balances (must be zero to certify) | Calculated amount = A – B |

Determine if you need to add, edit or delete a record [+]

- Click the Edit/Delete action tab. All saved records are displayed.

- If the agency and fund type combination is not listed, you need to add a record. Click the Add action tab. The system takes you to the Note Disclosures screen.

–OR–

If the agency and fund type combination is listed, you previously saved this record to the system. Only an edit or a delete to this record is allowed. Click Edit or Del for this record.

Add a record [+]

- Click the Add action tab.

- Select a fund type from the drop-down menu. The status box displays the message Processing. Please wait. indicating that DINSS is extracting the NAV balance from the Investments Fair Value disclosure screen.

- To enter the agency input amounts:

- Press Tab until the cursor moves to the agency input box where you want to enter amounts.

- Enter the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation.

- Click Save. The status box displays the message Saving data and the system takes you to the Edit/Delete action tab.

Edit a record [+]

- Click Edit for that record to access the edit screen. DINSS displays the agency input amounts as currently saved and the NAV balance from the Investments Fair Value disclosure screen.

- Press Tab until the cursor moves to the agency input box you want to edit.

- Edit the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation. You may edit and recalculate as many times as necessary before proceeding to the next step.

- Click Save. The status box displays the message Saving, Please wait. The system returns to the edit screen.

- Select another record to edit, proceed to a different disclosure screen or click Log Out to exit DINSS.

Delete a record [+]

- Click Del for that record to access the delete screen. DINSS displays the agency input amounts as currently saved and USAS GL account balances from the prior USAS cycle, if applicable.

- Click Confirm Delete. The status box displays the message Deleting, Please wait. The system returns to the delete screen. You may select another record to delete, proceed to a different disclosure screen or click Log Out to exit DINSS.

Investments – Custodial Credit Risk Disclosure Screen [+]

| Disclosure | Investment Custodial Credit Risk by Investment Type |

|---|---|

| Reconcile to USAS? | No |

| Amounts | All amounts in dollars and cents |

| Investments Custodial Credit Risk (in thousands) | |

|---|---|

| Field Title | Action |

Various investment types that are Uninsured and Unregistered with Securities Held by the:

|

Enter/edit amount |

Determine if you need to add, edit or delete a record [+]

- Click the Edit/Delete action tab. All saved records are displayed.

- If the agency and fund type combination is not listed, you need to add a record. Click the Add action tab. The system takes you to the Note Disclosures screen.

–OR–

If the agency and fund type combination is listed, you previously saved this record to the system. Only an edit or a delete to this record is allowed. Click Edit or Del for this record.

Add a record [+]

- Click the Add action tab.

- Select a fund type from the drop-down menu. The status box displays the message Processing. Please wait. indicating that DINSS is extracting the USAS GL account balances from the prior USAS cycle.

- To enter the agency input amounts:

- Press Tab until the cursor moves to the agency input box where you want to enter amounts.

- Enter the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation.

- Click Save. The status box displays the message Saving data and the system takes you to the Edit/Delete action tab.

Edit a record [+]

- Click Edit for that record to access the edit screen. DINSS displays the agency input amounts as currently saved and the USAS GL account balances from the prior USAS cycle, if applicable.

- Press Tab until the cursor moves to the agency input box you want to edit.

- Edit the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation. You may edit and recalculate as many times as necessary before proceeding to the next step.

- Click Save. The status box displays the message Saving, Please wait. The system returns to the edit screen.

- Select another record to edit, proceed to a different disclosure screen or click Log Out to exit DINSS.

Delete a record [+]

- Click Del for that record to access the delete screen. DINSS displays the agency input amounts as currently saved and USAS GL account balances from the prior USAS cycle, if applicable.

- Click Confirm Delete. The status box displays the message Deleting, Please wait. The system returns to the delete screen. You may select another record to delete, proceed to a different disclosure screen or click Log Out to exit DINSS.

Investments — Foreign Currency Risk Disclosure Screen [+]

| Disclosure | Investment Foreign Currency Risk by type of Foreign Investment |

|---|---|

| Reconcile to USAS? | No |

| Amounts | All amounts in dollars and cents |

To verify the agency input investment foreign currency risk amounts, DINSS automatically extracts the agency input investment fair value amounts by type of foreign investment from the Investments — Fair Value disclosure screen. Differences in this reconciliation must be no greater than plus or minus .01 before the agency can certify.

| Investments Foreign Currency Risk (in thousands) | |

|---|---|

| Field Title | Action |

| Balance held by Foreign Currency | |

| International Obligation | Enter/edit amount as a positive (A) |

| International Equity | Enter/edit amount as a positive (B) |

| International Other Commingled Funds | Enter/edit amount as a positive (C) |

| International Externally Managed Investment | Enter/edit amount as a positive (D) |

| Total Int’l Obligation Entered | Calculated amount (E) = Total of A |

| Int’l Obligation (from invest fair value) | Extracted from the Investments – Fair Value disclosure screen divided by 1,000 (F) |

| Difference must be no greater than plus or minus .01 (such as +.01 or -.01) before the agency can certify | Calculated amount = E – F |

| Total Int’l Equity Entered | Calculated amount (G) = Total of B |

| Int’l Equity (from invest fair value) | Extracted from the Investments – Fair Value disclosure screen divided by 1,000 (H) |

| Difference must be no greater than plus or minus .01 (such as +.01 or -.01) before the agency can certify | Calculated amount = G – H |

| Total Int’ Other Commingled Funds Entered | Calculated amount (I)= Total of C |

| Int’l Other Commingled Funds (from invest fair value) | Extracted from the Investments – Fair Value disclosure screen divided by 1,000 (J) |

| Difference must be no greater than plus or minus .01 (such as +.01 or -.01) before the agency can certify | Calculated amount = I – J |

| Total Int’l Externally Managed Investment Entered | Calculated amount (K) = Total of D |

| Int’l Externally Managed Investment (from invest fair value) | Extracted from the Investments — Fair Value disclosure screen divided by 1,000 (L) |

| Difference must be no greater than plus or minus .01 (such as +.01 or -.01) before the agency can certify | Calculated amount = (K) – (L) |

Determine if you need to add, edit or delete a record [+]

- Click the Edit/Delete action tab. All saved records are displayed.

- If the agency and fund type combination is not listed, you need to add a record. Click the Add action tab. The system takes you to the Note Disclosures screen.

–OR–

If the agency and fund type combination is listed, you previously saved this record to the system. Only an edit or a delete to this record is allowed. Click Edit or Del for this record.

Add a record [+]

- Click the Add action tab.

- Select a fund type from the drop-down menu. The status box displays the message Processing. Please wait. indicating that DINSS is extracting the USAS GL account balances from the prior USAS cycle.

- To enter the agency input amounts:

- Press Tab until the cursor moves to the agency input box where you want to enter amounts.

- Enter the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation.

- Click Save. The status box displays the message Saving data and the system takes you to the Edit/Delete action tab.

- If the international obligation, equity and other comingled funds investment fair value amounts are correct, proceed to a different disclosure screen or click Log Out to exit DINSS.

–OR–

If the international obligation, equity and other comingled funds investment fair value amounts are incorrect:- Go to the Investments – Fair Value disclosure screen in DINSS.

- Click Edit/Delete.

- Click Edit and correct the amounts.

- Proceed to a different disclosure screen or click Log Out to exit DINSS.

Edit a record [+]

- Click Edit for that record to access the edit screen. DINSS displays the agency input amounts as currently saved and the USAS GL account balances from the prior USAS cycle, if applicable.

- Press Tab until the cursor moves to the agency input box you want to edit.

- Edit the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation. You may edit and recalculate as many times as necessary before proceeding to the next step.

- Click Save. The status box displays the message Saving, Please wait. The system returns to the edit screen.

- Select another record to edit, proceed to a different disclosure screen or click Log Out to exit DINSS.

Delete a record [+]

- Click Del for that record to access the delete screen. DINSS displays the agency input amounts as currently saved and USAS GL account balances from the prior USAS cycle, if applicable.

- Click Confirm Delete. The status box displays the message Deleting, Please wait. The system returns to the delete screen. You may select another record to delete, proceed to a different disclosure screen or click Log Out to exit DINSS.

Investments – S&P Disclosure Screen [+]

| Disclosure | Investment Credit Risk S&P by Investment Type |

|---|---|

| Reconcile to USAS? | No |

| Amounts | All amounts in dollars and cents |

To verify the agency input total investments S&P credit risk amounts against USAS balances, the disclosure screen includes non-debt securities (for example, equity, etc.) and debt securities not subject to credit risk (for example, Ginnie Mae, etc.). Differences in this verification must be no greater than plus or minus .01 before the agency can certify.

| Investments Credit Risk S&P (in thousands) | |

|---|---|

| Field Title | Action |

| FV of non-debt securities | Enter/edit amount as a positive (A) |

| Fair Value of Debt Security NOT Subject to Investment Credit Risk | Enter/edit amount as a positive (B) |

| Enter S&P credit rating by type of investment | Enter/edit amounts as a positive (C) |

| Total Investments Credit Risk S&P Entered | Calculated amount (D) = A + B + C |

| GL Acct Class 005 Securities Lending Collateral | Extracted from USAS divided by 1,000 (E) |

| GL Acct Class 006 CA Cash Equivalent | Extracted from USAS divided by 1,000 (F) |

| GL Acct Class 008 CA Short Term Investments | Extracted from USAS divided by 1,000 (G) |

| GL Acct Class 014 CA Restricted Cash Equivalents | Extracted from USAS divided by 1,000 (H) |

| GL Acct Class 016 CA Restricted Short Term Investments | Extracted from USAS divided by 1,000 (I) |

| GL Acct Class 123 NC Restricted Cash Equivalent | Extracted from USAS divided by 1,000 (J) |

| GL Acct Class 128 NC Restricted Short Term Investments | Extracted from USAS divided by 1,000 (K) |

| GL Acct Class 130 NC Restricted Investments | Extracted from USAS divided by 1,000 (L) |

| GL Acct Class 147 NC Investments | Extracted from USAS divided by 1,000 (M) |

| Difference must be no greater than plus or minus .01 before the agency can certify | Calculated amount = D – E – F – G – H – I – J – K – L – M |

Determine if you need to add, edit or delete a record [+]

- Click the Edit/Delete action tab. All saved records are displayed.

- If the agency and fund type combination is not listed, you need to add a record. Click the Add action tab. The system takes you to the Note Disclosures screen.

–OR–

If the agency and fund type combination is listed, you previously saved this record to the system. Only an edit or a delete to this record is allowed. Click Edit or Del for this record.

Add a record [+]

- Click the Add action tab.

- Select a fund type from the drop-down menu. The status box displays the message Processing. Please wait. indicating that DINSS is extracting the USAS GL account balances from the prior USAS cycle.

- To enter the agency input amounts:

- Press Tab until the cursor moves to the agency input box where you want to enter amounts.

- Enter the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation.

- Click Save. The status box displays the message Saving data and the system takes you to the Edit/Delete action tab.

- If the USAS GL account balances are correct, proceed to a different disclosure screen or click Log Out to exit DINSS.

–OR–

If the USAS GL account balances are incorrect, click Log Out to exit DINSS. Enter a USAS transaction to change the incorrect USAS GL account balance. Wait for a USAS cycle to process in order for DINSS to update with the new USAS balance.

Edit a record [+]

- Click Edit for that record to access the edit screen. DINSS displays the agency input amounts as currently saved and the USAS GL account balances from the prior USAS cycle, if applicable.

- Press Tab until the cursor moves to the agency input box you want to edit.

- Edit the amounts.

- Press Tab. If you have Javascript, DINSS automatically calculates totals and differences, where applicable. If you do not have Javascript, click Calc Totals for recalculation. You may edit and recalculate as many times as necessary before proceeding to the next step.

- Click Save. The status box displays the message Saving, Please wait. The system returns to the edit screen.

- Select another record to edit, proceed to a different disclosure screen or click Log Out to exit DINSS.

Delete a record [+]

- Click Del for that record to access the delete screen. DINSS displays the agency input amounts as currently saved and USAS GL account balances from the prior USAS cycle, if applicable.

- Click Confirm Delete. The status box displays the message Deleting, Please wait. The system returns to the delete screen. You may select another record to delete, proceed to a different disclosure screen or click Log Out to exit DINSS.